Hindenburg, a US-based short seller firm, is shutting down. The notorious research firm is known for its played havoc on the fortunes of several countries worldwide.

On 15 January, its founder, Nate Anderson, said that the firm had completed the projects it was working. The firm was founded in 2017 with ten employees as corporate muckrakers, and since then, it has pushed several corporations to admit accounting errors or misrepresentations.

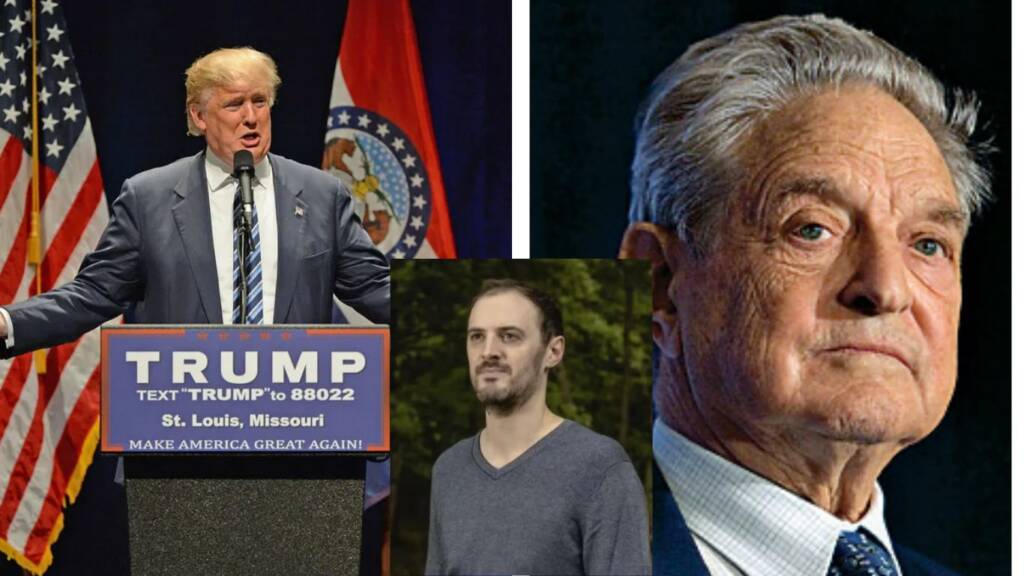

According to experts’ opinions, Trump’s return may have caused the firm to hurtle towards a suddenly closure. Hindenburg is associated with George Soros, and Soros is known as one of the biggest backers of the Democrat party.

Trump looks to be on a mission as he had openly declared that he will go after deep-state assets responsible for destabilizing his first term. Hindenburg, an associated firm with Georg Soros, seems to have taken considerable heed to these warnings from Trump as it looks to avoid possible investigation or accountability.

The firm has not only wiped billions of dollars off several companies but also attacked multiple international business groups by accusing them of “brazen” corporate fraud.

Hindenburg’s biggest success came just three years after its foundation. The firm accused electric truck maker Nikola of lying about the status of its technology. It has alao previously managed to cause a negative stir in the Indian share market with its contrived speculations.

Making a statement on the closure, the firm’s founder Anderson said, “The plan has been to wind up after we finished the pipeline of ideas we were working on.” He further added, “And as of the last Ponzi cases we just completed and are sharing with regulators, that day is today.”

Hindenburg did a so-called investigation leading to all kinds of charges against nearly a hundred individuals, including entire corporations and oligarchs. Here are some notable cases where Hindenburg was heavily involved and managed to cause an economic stir.

The first successful attempt – Nikola Corporation- 2020

In one of its most well-known short sells, Hindenburg targeted electric truck manufacturer Nikola in 2020. The short seller claimed Nikola misled investors about its technological developments. Anderson contested a video Nikola created that showed its electric truck cruising at high speeds despite the fact that the vehicle was rolled down a slope. In 2022, a jury in the US convicted Nikola’s founder, Trevor Milton, of fraud for allegedly lying to investors. This report caused a significant blow to the company, and it never recovered.

The Twitter Story – 2022

In 2022, Hindenburg invested in Twitter Inc., first short and later long. Hindenburg claimed in May that it was short because it felt Elon Musk’s $44 billion plan to take the firm private would be repriced lower if the world’s richest person backed out. Anderson revealed a “significant long position,” betting against Musk, in July. The transaction for Twitter was completed in October at the original price.

J&J Purchasing Ponzi Scheme – 2022

Hindenburg’s investigation into J&J Purchasing, a $400 million Ponzi fraud, began in 2022 after the firm acquired hidden camera footage. This tape shows J&J salespeople promoting bogus investment plans, prompting a dramatic FBI intervention that resulted in a standoff and the confession of the scheme’s lawyer. The case received worldwide attention and ended in criminal proceedings against those involved. In 2022, the SEC brought charges against J&J and its top executives, effectively ending the Ponzi scam.

Icahn Enterprises LP case – 2023 – 2024

In 2023, Hindenburg Research criticized Icahn Enterprises LP’s (IEP) financial reporting. Hindenburg accused IEP of overvaluing its assets and using a “Ponzi-like” structure to pay dividends. According to Forbes, the ensuing collapse in IEP shares reduced Icahn’s net worth by $2.9 billion, leaving him with an estimated $14.7 billion. Icahn stated in an IEP statement that Hindenburg’s “self-serving“ study was designed to maximize profits at the detriment of IEP’s long-term stockholders.

Allegations against Block Inc- 2023

In 2023, Hindenburg Research announced short holdings in Block Inc., alleging that the payments startup run by Twitter co-founder Jack Dorsey misrepresented user numbers and undervalued customer acquisition costs. The move was seen as a threat to Dorsey, who co-founded Block in 2009 in his San Francisco apartment with the purpose of shaking up the credit card industry. He was the company’s largest shareholder, owning approximately 8%. Block threatened to fight back, stating that it would consider legal action against the short seller for its “factually inaccurate and misleading report“ that was “designed to deceive and confuse investors”.

Attacks on Indian Economy

The short seller actively targeted the Adani Group, publishing reports throughout 2023 that resulted in significant financial consequences for Gautam Adani. Hindenburg’s charges took down a significant portion of Adani Group’s market value. However, the group eventually recovered the majority of its stock market losses. Despite the gravity of Hindenburg’s allegations, Adani and his firms have repeatedly rejected any charges brought against them. The Adani group is a big conglomerate in India that has contributed a lot to Indian growth. Experts have pointed out several times this report was to target not only the Adani groups but also the growing Indian economy.

Last year, Hindenburg accused SEBI Chairperson Madhabi Puri Buch and her husband Dhaval Buch of a conflict of interest, stating they owned holdings in offshore businesses tied to the suspected Adani money siphoning. These claims were based on papers provided by a whistleblower and other investigations. After several failed attacks, the recent attack came on SEBI destabilized the Indian economy by questing the Indian state institution.