A recent claim by Russian presidential adviser Anton Kobyakov has sparked waves across the global financial and crypto communities. Speaking at the Eastern Economic Forum, Kobyakov alleged that Washington could use stablecoins—digital assets pegged to fiat currencies—to effectively “erase” or restructure its $35–37 trillion national debt.

The assertion, amplified by Indian IPR lawyer and analyst Navroop Singh on social media platform X, alleged that the U.S. might convert its debt into U.S.-backed digital tokens, devalue them, and “reset” the global financial system.

At face value, the statement taps into growing skepticism about U.S. debt sustainability and the role of digital assets in global finance. However, upon closer analysis, the claim falls apart under the weight of economic, legal, and technological realities.

Stablecoins Are Private, Not Sovereign

Stablecoins such as USDT (Tether) and USDC (Circle) are issued by private corporations—not by the U.S. Treasury or Federal Reserve. They maintain their value by holding reserves in cash or short-term U.S. Treasury bills, ensuring a 1:1 peg with the U.S. dollar.

While these issuers do hold a portion of U.S. debt instruments (approximately $285 billion combined as of 2025), this is minuscule compared to the $35 trillion national debt. The idea that the U.S. could “convert” its liabilities into privately issued digital assets is not just technically implausible—it would legally constitute a sovereign default.

Legal and Regulatory Roadblocks

Under the GENIUS Act of 2025 (Government-Enabled Network for Institutional Utility Stablecoins), stablecoin issuers are mandated to:

Maintain 100% collateralization in cash or near-cash assets.

Operate under the oversight of the Federal Reserve, Office of the Comptroller of the Currency (OCC), and FinCEN.

Avoid issuing or restructuring sovereign debt instruments.

This regulatory framework effectively prevents any attempt by the U.S. government to treat stablecoins as tools for debt monetization or financial engineering. They are payment instruments, not instruments of fiscal restructuring.

Tokenized Treasuries: A Different Concept

Some confusion stems from the emergence of tokenized Treasuries, such as Franklin Templeton’s BENJI fund, which allows blockchain-based investors to hold digital representations of Treasury securities. However, these tokenized assets are investment vehicles, not instruments to write off or “erase” public debt.

These products offer efficiency—instant settlement, fractional ownership, and transparent auditing—but they operate within existing financial structures, not as alternatives to them.

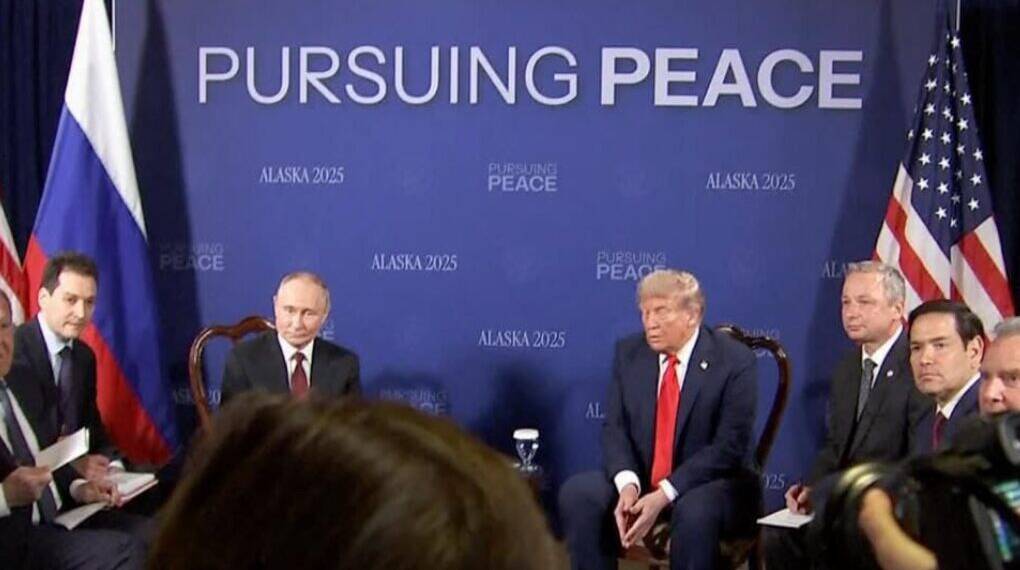

Geopolitical Rhetoric Behind the Claim

Kobyakov’s remarks appear less an economic forecast and more a geopolitical maneuver. Russia, facing sustained Western sanctions and exclusion from the SWIFT network, has often sought to discredit the U.S.-led financial order. By suggesting that the U.S. is planning to “reset” its debt via crypto, Moscow’s narrative aims to undermine confidence in the dollar-based global system.

Crypto and macroeconomic analysts have widely dismissed the claim as rhetorical posturing, comparing it to earlier statements by Russian officials alleging that the U.S. manipulates global finance through digital means.

Technical and Operational Barriers

Even if Washington were to explore such a radical idea, the technological and operational hurdles would be insurmountable:

Blockchain architecture operates continuously (24/7), while federal debt markets and central banking systems follow regulated trading hours.

Interoperability between blockchain and legacy systems remains limited, despite advancements in financial tokenization.

Regulatory compliance for such a conversion would require rewriting the entire U.S. financial code, including the Federal Reserve Act and Securities Exchange Act.

In other words, there is no legal, infrastructural, or fiscal framework that could enable the United States to restructure its sovereign debt via stablecoins or crypto assets.

The Real Picture: Controlled Digital Finance Evolution

While the U.S. government has expressed interest in blockchain applications—especially for Central Bank Digital Currencies (CBDCs) and tokenized Treasuries—these initiatives are about efficiency and transparency, not financial escape hatches.

The Federal Reserve, Treasury Department, and SEC have been cautious in their approach, emphasizing risk management, regulatory compliance, and monetary control over experimentation. Any attempt to use crypto for debt “erasure” would directly contradict this policy trajectory.

Kobyakov’s statement underscores how crypto narratives can be weaponized in global information wars. While stablecoins and blockchain are increasingly integrated into legitimate financial systems, their function remains supportive—not substitutive—to traditional sovereign finance.

In reality, the U.S. debt cannot be digitally erased through stablecoins without triggering catastrophic economic fallout, global trust collapse, and legal chaos. The world’s largest economy operates within a structured, rule-bound system—one that cannot be reset with code, no matter how persuasive the rhetoric sounds.