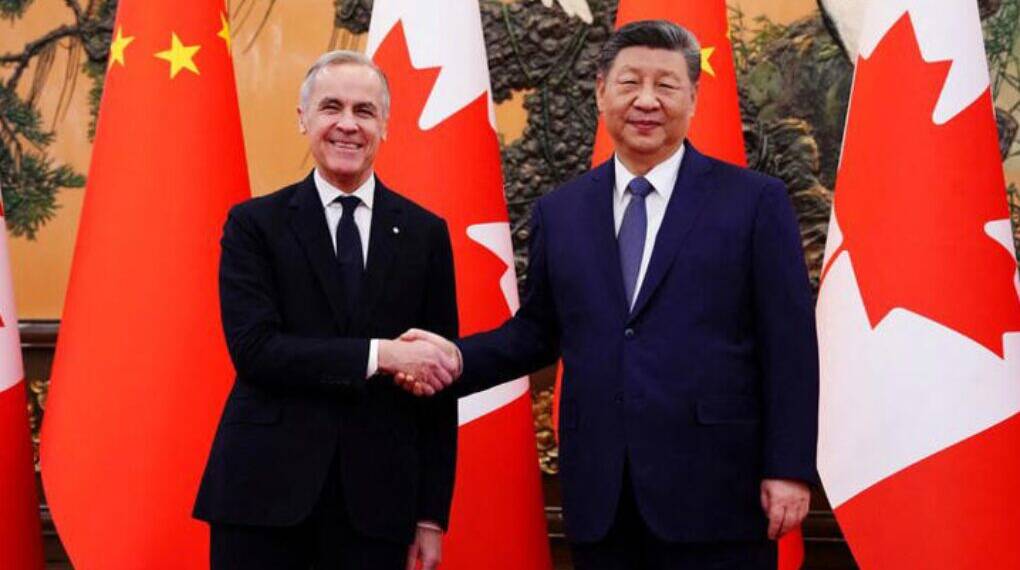

The announcement of a major trade reset between China and Canada following talks between Chinese President Xi Jinping and Canadian Prime Minister Mark Carney in Beijing has sent ripples through global geopolitics. After years of strained relations, tit-for-tat tariffs, and diplomatic freezes, the two countries have agreed to significant tariff relief, renewed strategic dialogue, and deeper economic cooperation, with Carney openly framing the move as part of a transition toward a “new world order.”

This development is not occurring in isolation. It comes amid intensifying U.S.–China rivalry, renewed protectionism under U.S. President Donald Trump, NATO strains over the Arctic and Greenland, and a broader erosion of the post–Cold War Pax Americana.

What the China–Canada Trade Deal Includes?

At the core of the agreement is a rollback of punitive tariffs that had damaged bilateral trade since 2024.

Key tariff changes

China will reduce tariffs on Canadian canola oil and seed from a combined rate of roughly 84–85% to about 15% by March 1, 2026.

Canada will lower tariffs on Chinese electric vehicles (EVs), allowing up to 49,000 Chinese EVs into the Canadian market at the most-favoured-nation (MFN) rate of 6.1%.

This replaces the 100% EV tariff imposed by Canada in 2024, which closely followed U.S. restrictions on Chinese EV imports.

The new arrangement effectively restores trade volumes to pre-crisis levels while embedding them in a broader framework of cooperation rather than confrontation.

Why Had Relations Broken Down?

Canada–China relations deteriorated sharply over the past decade due to:

Canada’s alignment with U.S. trade restrictions on China

Concerns over state subsidies in Chinese manufacturing

Retaliatory Chinese tariffs on Canadian agricultural products

Political tensions related to human rights and election interference concerns

China’s retaliation in 2024 targeted over $2.6 billion worth of Canadian farm and food exports, including canola, lobsters, peas, and seafood. By 2025, Chinese imports of Canadian goods had fallen by more than 10%, severely affecting Canadian farmers.

Trade Diversification Away from the United States

Prime Minister Mark Carney has been explicit about the motivation behind the reset: reducing Canada’s overdependence on the United States.

Under President Trump, Washington has reintroduced on-again, off-again tariffs on allies, including Canada, creating uncertainty for Canadian exporters and investors. Trump has also reignited controversial rhetoric, including suggestions that Canada could become America’s “51st state” and renewed pressure over Greenland.

Against this backdrop, Carney has argued that Canada must pursue a “more competitive, sustainable, and independent economy” capable of weathering global trade disruption.

China, as Canada’s second-largest trading partner, is central to that strategy.

Strategic Cooperation Beyond Tariffs

The agreement goes far beyond agriculture and EVs.

Energy and climate cooperation

Canada plans to double its energy grid capacity over the next 15 years

Opportunities for Chinese investment in offshore wind, energy storage, and clean energy production

Canada aims to produce 50 million tonnes of LNG annually by 2030, all targeted for Asian markets

Carney emphasized that cooperation with China could accelerate Canada’s net-zero transition, create high-quality jobs, and integrate Canadian firms into global clean-energy supply chains.

Geopolitical Implications for the United States

The China–Canada rapprochement carries clear strategic implications for Washington.

While Canada remains a core U.S. ally embedded in NATO, intelligence-sharing, and defense structures, its economic pivot sends a powerful signal: U.S.-led decoupling from China is not universally accepted—even among America’s closest partners.

Analysts note that Beijing is eager to showcase cooperation with a G7 country in what has traditionally been a U.S. sphere of influence. For China, Canada’s pragmatic engagement helps undermine the narrative of Western unity against Beijing.

Carney himself underscored this autonomy by stating that Canada’s partnership with China has become “more predictable”—a pointed comparison to the volatility of current U.S. trade policy.

Greenland, NATO, and the Arctic Dimension

The talks also touched on sensitive Arctic geopolitics. Carney revealed that he discussed Greenland with President Xi and found “much alignment of views.”

This comes as Trump has revived claims over Greenland’s strategic importance, unsettling NATO allies. In response, Carney issued a clear message:

Canada’s commitment to NATO Article 5 remains absolute

Ottawa will back Denmark on Greenland

This statement is widely interpreted as a warning to Washington that Canada will not support unilateral U.S. actions that destabilize allied territory.

Is This the Beginning of the End of Pax Americana?

Carney’s declaration that the China–Canada partnership helps shape a “new world order” has drawn global attention. While Canada is not abandoning the United States, its actions reflect a broader trend among middle powers: strategic hedging in a multipolar world.

Trump’s tariff-driven diplomacy and pressure on allies may prove to be his most lasting foreign policy legacy—not by strengthening U.S. dominance, but by accelerating its relative decline.

Canada’s recalibration toward China suggests that the foundations of the old order are shifting. The emerging system is one where alliances remain, but economic sovereignty, diversification, and autonomy increasingly define national strategy.

As this reset unfolds, one thing is clear: the era of unquestioned American economic leadership is being challenged—not by rivals alone, but by allies adapting to a changing world.