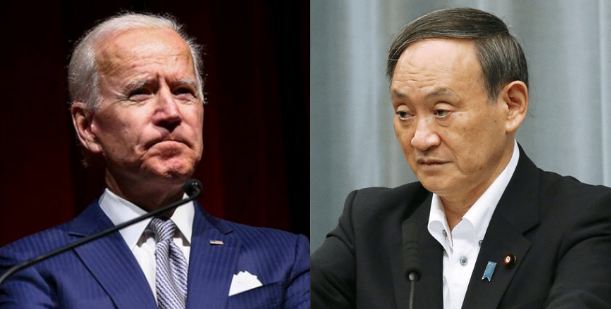

Joe Biden has turned out to be a really ambitious man. After pushing socialist policies within the USA’s borders, he is trying to push similar policies globally, however, there are no takers in the G7 and among many others Japan has more specifically shown its disdain for the same. Finance leaders from the Group of Seven rich countries are unlikely to debate specific figures on minimum tax rates at their weekend meeting, Finance Minister Taro Aso said. Aso said he is planning on a bilateral meeting with the US. Treasury Secretary Janet Yellen on the sidelines of the June 4-5 G7 meeting in Britain, although the details weren’t finalised, as per Reuters.

Finance ministers from the Group of Seven nations were expected to back President Biden’s call for a worldwide minimum tax on corporate profits at a summit in London on Friday, delivering him an early victory in a hard diplomatic campaign that is just getting started. However, the comments of the Japanese Finance Minister and reservations from some other countries be them G7 or otherwise are making things complicated.

The new minimum tax, which is one side of a two-pronged worldwide reform movement, aims to break the loop of corporate tax cuts that has drained governments around the world of money. Negotiators are also grappling with European requests to tax American technology firms like Google and Facebook, which earn significant revenue in countries where they have little physical presence, as part of a package deal.

As per WaPo, Biden catalyzed the global tax debate this month by lowering to 15 percent from 21 percent his proposed worldwide minimum. If he can secure agreement from the world’s leading democracies — en route to a broader global consensus later this year — it could eventually produce the most significant global tax shift in decades.

“I don’t think the June meeting would reach a debate on specific figures,” Aso told reporters after a cabinet meeting. Asked about Japan’s position on minimum global tax and how he would address Japan’s stance in a meeting with Yellen at G7, Aso did not elaborate further, saying that the matter has not been put formally on agenda.

Biden’s initiatives are opposed by business leaders. Even as a proposal for a global minimum tax appears to be gathering traction at the G7, business executives say that disparities in the structure of European and American tax systems — such as which expenses can be deducted from taxable income — make a uniform corporate tax difficult to implement.

“All we know is they’re talking about a rate. We don’t know what it applies to. We don’t know how it applies,” said Catherine Schultz, vice president for tax and fiscal policy at the Business Roundtable.

While there are differences that the G7 leaders are trying to play down, it does not change the fact that Biden’s global corporate tax push finds no takers in G7 and Japan’s subtle yet specific hostility will make it all the more difficult.