Biden’s gamble with seizing Russian assets might be backfiring quicker than anticipated. The idea of confiscating these properties to aid Ukraine seemed like a strategic move at first, but it’s evolving into a potential catastrophe. Renowned economist Robert Shiller’s dire warnings aren’t just raising eyebrows; they’re casting a shadow over the stability of the global economic order.

Shiller, a distinguished economist recognized for his expertise in financial markets and empirical analysis, voices significant concerns about the potential fallout of seizing Russian assets. His warnings resonate with the notion that such an act would jeopardize the status of the US dollar as a reliable global reserve currency.

According to Shiller, seizing the assets would give the global community, especially countries which, like Russia, “convert their savings into dollars and thus entrust them in the reliable hands of Uncle Sam,” grounds to doubt the US currency.

Join us on Telegram: https://t.me/tfiglobal

“If America does this to Russia today… then tomorrow it can do this to anyone. This will destroy the halo of security that surrounds the dollar and will be the first step towards de-dollarization, which many are increasingly confidently leaning toward, from China to developing countries, not to mention Russia itself,” the economist warned.

“I can’t convince myself that this [confiscation of Russian assets] is the right way,” he explained.

Read More: EU chalks out a plan to wickedly confiscate $300 billion of Russian assets

“In addition to the fact that this will be confirmation for the Russian leader that what is happening in Ukraine is a proxy war, it could paradoxically turn against America and the entire West,” Shiller explained, adding that the situation would likely turn into “a cataclysm for the current dollar-dominated economic system.”

The consideration of seizing frozen Russian assets amid the Ukraine conflict has sparked profound geopolitical implications and echoes reminiscent of past global economic shifts. Shiller’s cautionary words resonate not just in the current context but draw parallels to historical instances that altered the course of the global economic order.

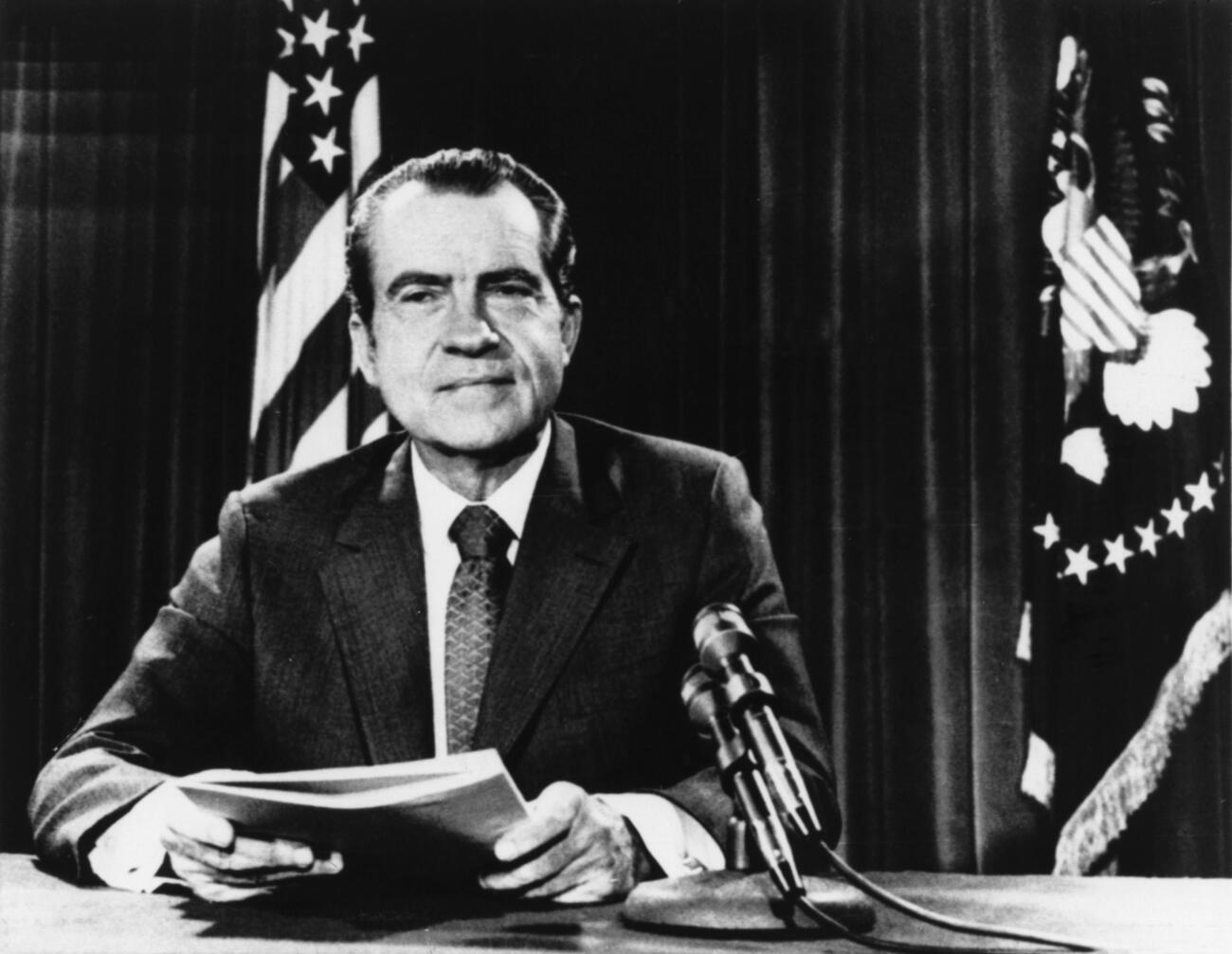

One notable example is the ramifications of the United States’ past decisions that influenced global economic dynamics. The imposition of the Nixon Shock in 1971, when the US abandoned the gold standard, significantly impacted global currency systems. This pivotal move triggered fluctuations in exchange rates and prompted countries to reconsider their reliance on the US dollar as a reserve currency. It underscored how one nation’s policy decision could ripple through the international financial landscape, shaking the foundation of global economic stability.

Additionally, the emergence of alternative economic alliances also signifies the potential for economic realignment. The formation of the Eurasian Economic Union (EAEU) among countries like Russia, Belarus, Kazakhstan, Armenia, and Kyrgyzstan presents an alternative economic bloc that, if strengthened, could challenge the dominance of traditional Western economic alliances.

Read More: The first European country to begin the de-dollarization moment

Overall, Shiller warns the erosion of trust in the dollar’s reliability could trigger a domino effect, with countries contemplating de-dollarization and seeking alternative reserve currencies, posing a significant challenge to the prevailing economic order.

Amid these discussions, the West grapples with ethical dilemmas regarding the utilization of approximately $300 billion in frozen Russian foreign exchange reserve assets. These assets, seized as part of sanctions imposed, remain a subject of deliberation among Western nations regarding their potential allocation to aid Ukraine. However, the move to legalize the confiscation of these assets by recognizing Western countries as injured parties in the Ukraine conflict faces resistance from Russia, labeling the freezing and planned confiscation as unlawful.

Shiller’s serious alerts arrive amidst a pivotal phase for the world economy. Additionally, numerous nations are moving closer to de-dollarization, a significant shift away from reliance on the US dollar. This trend is noticeable among BRICS+ nations, marking a collective move toward decreasing their dependence on the dollar.

Countries within the BRICS+ alliance, which encompasses a coalition beyond the BRICS nations, are steadily steering towards de-dollarization. This strategic movement aims to diminish their reliance on the US dollar in international transactions and reserves. Led by influential economies like China, Russia, India, and others, these nations are increasingly emphasizing bilateral trade agreements using their local currencies, reducing their vulnerability to the potential fluctuations and influences associated with the US dollar-dominated financial system, marking a shift in global financial dynamics.

Read More: BRICS Expansion: Implications for Global Economic Balance

With Shiller’s cautionary flags about the fate of the dollar and the escalating tendencies of de-dollarization among influential nations, the repercussions of this action are poised to reverberate far beyond the current geopolitical tensions, possibly reshaping the world’s financial landscape. Biden’s administration might be facing more than it bargained for in this high-stakes game.

Recommended Video: