In the context of escalating tensions with North Korea, South Korea is diversifying its global contributions beyond the realms of K-pop and K-drama. President Yoon Suk Yeol has endorsed what is now termed as “K-Defense,” signaling the nation’s foray into the international weapons market. Notably, during a visit to Hanwha Aerospace, a prominent player in South Korea’s growing defense sector, President Yoon expressed support for this strategic shift.

“Some people have considered the defense industry to be a war industry and have had negative opinions about it,” read Yoon’s message. “In fact, the defense industry is a peaceful industry that shares our values in the global security system while guaranteeing the safety of our allies and people who respect the international order.”

Join us on Telegram: https://t.me/tfiglobal

South Korea, traditionally known for semiconductor, automotive, and cultural exports such as boy bands, has witnessed a notable surge in the global prominence of its defense companies. These firms, shaped by decades of tension with North Korea, have secured significant international contracts in recent years.

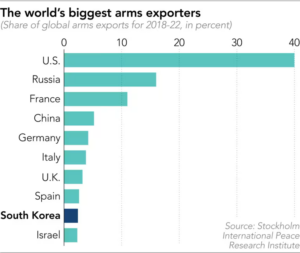

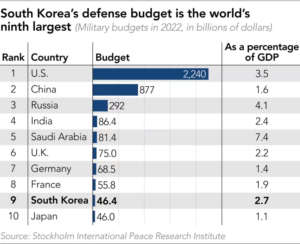

Despite being recognized as a technological powerhouse in areas such as chips and batteries, South Korea has also emerged as the world’s ninth-largest arms exporter. Notably, its arms exports have surged by 74% in the five-year period from 2018 to 2022. President Yoon has set an ambitious target, aiming to elevate South Korea to the fourth position among global arms exporters by 2027.

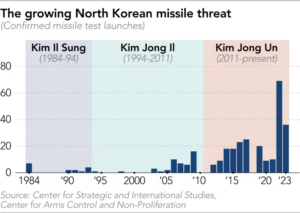

South Korea’s defense industry is rooted in the imperative to safeguard against the formidable threat posed by its well-armed neighbor, North Korea. In response to North Korea’s advancements in nuclear weapons and sophisticated arms, South Korea has cultivated a robust domestic weapons manufacturing infrastructure. The recent escalation in global demand due to the conflict in Ukraine has presented South Korean companies with opportunities to fill the void, particularly in the shortage of artillery shells.

These companies, notably Hanwha Aerospace and Korea Aerospace Industries, have capitalized on their capacity to swiftly fulfill orders, positioning themselves as reliable suppliers amid global backlogs. A senior analyst at the Australian Strategic Policy Institute, Euan Graham said,”The country has an industrial infrastructure whereby it can quickly provide arms to countries that need them, and buying from Korea is good policy from a value-for-money perspective.”

Read More: Avdeyevka Falls, Ukraine Defenseless Against Russia!

Hanwha Aerospace, a major player in South Korea’s defense sector, secured a monumental deal with Poland, supplying self-propelled howitzers. This agreement, valued at over $2.6 billion, is part of a larger $22 billion framework to provide artillery and rocket launchers to Poland, marking a milestone in South Korea’s ascent in the global arms trade.

Korea Aerospace Industries has also made significant strides, securing a deal exceeding $1 billion to supply attack helicopters to the South Korean army and embarking on the production of KF-21 fighter aircraft as part of a substantial 10-year project.

LIG Nex1, another key player, secured a $3.2 billion deal to export mid-range surface-to-air missiles to Saudi Arabia and is collaborating with Hyundai Rotem to enhance their data-sharing capabilities for increased contract acquisition in the Middle East. These companies often collaborate closely with the government, with the Ministry of National Defense routinely disclosing details of overseas deals.

South Korea’s arms industry has experienced a resurgence in global recognition, particularly in the wake of Russia’s invasion of Ukraine. Military analyst Kim Dae-young contends that, before the conflict, domestic defense companies primarily focused on a diminishing home market. However, the Ukraine war prompted a shift in perceptions, revitalizing these companies.

The European allies of Ukraine faced challenges in swiftly replenishing munitions due to limited stocks and industrial capacity. This created an opportunity for South Korea to supply munitions to Ukraine through a back-channel agreement with the U.S.

South Korea’s aspirations to become a defense-industry powerhouse encounter a complication in the form of the Foreign Trade Act, which prohibits arms exports to war zones. Stemming from concerns dating back to the 1950-53 Korean War, South Korea’s cautious stance on the Ukraine conflict avoids taking sides, demonstrated by its refusal to provide military items despite direct requests from Ukrainian President Zelensky.

By refraining from directly arming Ukraine and adopting a careful approach, South Korea has maintained bilateral relations with Russia. Despite tensions and increased military cooperation between Russia and North Korea, South Korea’s role in the Ukraine conflict highlights its potential as a swift and reliable arms exporter, distinguishing itself from competitors in terms of delivery speed and compatibility with NATO standards.

To navigate export restrictions, South Korea shipped shells to the U.S., allowing the U.S. to replenish its stocks and provide munitions to Ukraine.

Read More: ICJ Drops Bombshell: Ukraine’s Lies Exposed About Russia!

Critics within South Korea raise concerns about the country’s emerging role as a weapons manufacturer, considering its history of enduring a harsh civil war in the early 1950s and the ongoing tense standoff with North Korea. Kim Han Min-yeong from the civic group Peacemomo emphasizes the 70-year impact of war on South Koreans and the responsibility to prevent war due to its destructive nature.

Hwang Soo-young, an activist with People’s Solidarity for Participatory Democracy, questions the government’s promotion of “K-defense” and the slogan “peace through strength,” asserting that arming countries heavily may not realistically lead to peace, advocating instead for dialogue and negotiations.

Despite such domestic skepticism, mainstream resistance to the growth of the arms industry remains limited. Analysts anticipate South Korea to continue indirectly supplying Ukraine with munitions through arrangements with the U.S., carefully avoiding open violations of domestic laws or antagonizing Russia.

Terence Roehrig, a professor at the U.S. Naval War College, predicts that while South Korea’s munition sales contribute to Kyiv’s defense efforts, they may not be sufficient without substantial direct military assistance from the United States and the West.

South Korea’s foreign ministry, responding to queries, stated its humanitarian and financial aid to Ukraine as a member of the international community but refrained from addressing potential shifts in its stance on providing lethal aid.

The ongoing $22 billion deal with Poland faces delays over funding gaps from export credit agencies, with the South Korean legislature debating a proposed bill to facilitate lending for weapons purchases and avoid delays. The bill aims to raise the size of loans from the Export-Import Bank of Korea, currently capped at 40% of its equity capital. The defense cooperation between South Korea and Poland, despite challenges, is viewed as promising.

The People Power Party is urgently advocating for the passage of a bill seen as crucial for safeguarding a key industry, while the Democratic Party, holding a legislative majority, expresses concerns about potential excessive state funds allocation to the arms sector. With South Korea facing crucial legislative elections in April, partisan disputes may temporarily impede the bill’s progress.

This delay prompts apprehension regarding the sustainability of the South Korean arms industry’s recent boom, initiated by the Ukraine conflict. Erik Mobrand, an expert on South Korean politics at Seoul National University, underscores the cyclical nature of the arms sector, characterized by significant fluctuations due to the substantial scale of deals.