U.S. President Donald Trump has announced a major trade deal with Japan that significantly alters their bilateral economic relationship. The centerpiece of the agreement is a 15% reciprocal tariff on Japanese imports to the United States, a substantial reduction from the 25% tariffs that were initially due to take effect on August 1 if negotiations failed.

This tariff cut applies specifically to Japan’s critical automotive sector, which accounts for more than a quarter of Japanese exports to the U.S., and also extends to other Japanese goods scheduled for tariff increases, reducing their duties from 25% to 15%.

Key Elements of the Trade Deal

15% Reciprocal Tariffs: Japanese autos and parts, a pivotal sector representing over 25% of Japan’s U.S. exports, will now face a 15% tariff, down from the threatened 25%. Duties on other Japanese imports due to be raised on August 1 also saw their tariffs lowered by the same margin—from 25% down to 15%.

$550 Billion Japanese Investment Package: Japan has pledged up to $550 billion in investments, including loans and guarantees from government-affiliated institutions. These funds are aimed at bolstering resilient U.S. supply chains in strategic industries such as pharmaceuticals and semiconductors.

Expanded Market Access: Japan will increase purchases of U.S. agricultural goods including rice, trucks, and automobiles. Although U.S. rice imports to Japan may grow under this deal, Japanese officials emphasized the agreement does not compromise Japanese agriculture.

Exclusions: Japanese steel and aluminum exports remain subject to the existing 50% tariff and were not included in this agreement. There also was no new agreement on defense budgets.

Market and Economic Impact

The deal announcement sparked strong positive reactions in financial markets. Japan’s benchmark Nikkei 225 stock index surged over 3% to its highest level in a year, led by automakers Toyota and Honda, which jumped more than 14% and nearly 12%, respectively. The yen slightly firmed against the dollar amid optimism. The excitement also spread to South Korean carmakers’ shares amid hopes for similar deals.

Strategic Trade Importance

Autos are central to U.S.-Japan trade and have long been a sore spot for President Trump, who highlighted the imbalanced trade flow—while the U.S. imported over $55 billion worth of vehicles and auto parts from Japan in 2024, only about $2 billion of U.S. vehicles were sold to Japan. Overall, two-way trade between the countries approached $230 billion in 2024, with Japan maintaining a $70 billion trade surplus, making it the U.S.’s fifth-largest trading partner for goods.

Japan is also the largest foreign investor in the U.S., with approximately $1.2 trillion in direct investments and total market investments nearing $2 trillion, including institutional funds and insurers.

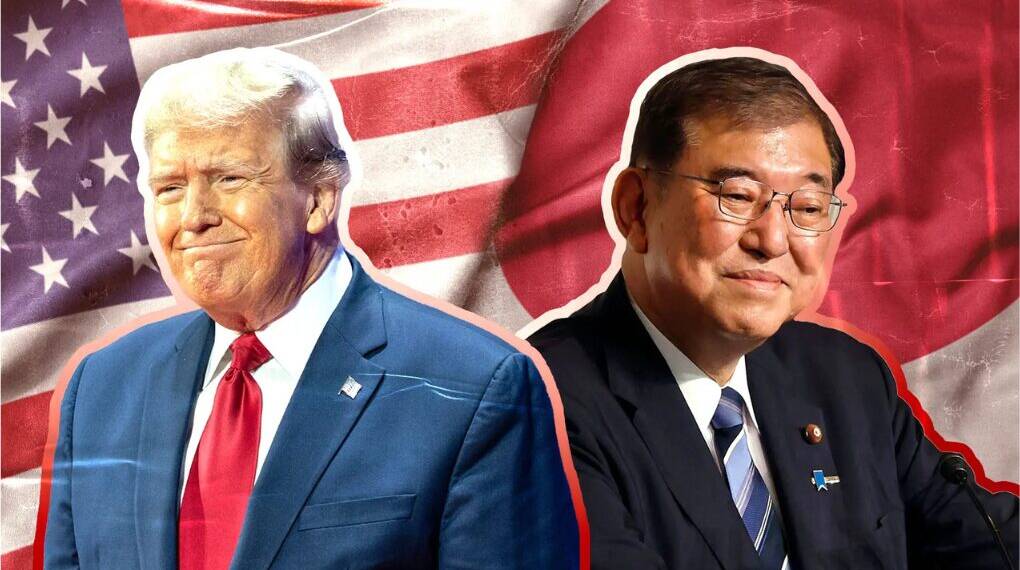

Prime Minister Shigeru Ishiba, who faces an imminent resignation following a recent election defeat, described the deal as “the lowest figure among countries that have a trade surplus with the U.S.,” signaling relief and satisfaction with avoiding harsher tariffs. Trump called the deal the “largest trade deal in history,” celebrating the strengthened U.S.-Japan relationship and calling the moment “very exciting.”

Tokyo’s chief trade negotiator Ryosei Akazawa described the agreement as “#MissionComplete” on social media, noting that it excluded Japanese steel and aluminum exports as well as defense budget discussions.

American automakers voiced strong criticism, decrying the deal as unfair because it cuts tariffs on Japanese auto imports while maintaining a 25% tariff on vehicles and parts imported from U.S. factories in Canada and Mexico, despite these North American vehicles having significant U.S. content. Matt Blunt of the American Automotive Policy Council warned that this could disadvantage U.S. industry and auto workers.

Critics have also pointed out the opaque nature of the $550 billion investment package, questioning the lack of detailed information about the structure, enforcement, and how the U.S. will realize its reported 90% share of profits from these Japanese investments.

The Trump administration is pushing aggressively on multiple trade fronts as the August 1 deadline for escalating tariffs approaches. Besides Japan, trade frameworks have been announced or negotiated with countries including Britain, Vietnam, Indonesia, and the Philippines. Negotiations with the European Union continue, with EU diplomats scheduled to meet in Washington shortly after this trade deal was made public.

Trump also expressed optimism about a forthcoming joint venture with Japan to support a long-planned liquefied natural gas (LNG) pipeline project in Alaska, signaling ongoing cooperation beyond tariffs and trade terms.

President Trump‘s “massive” trade deal with Japan replaces threatened steep tariffs with a reduced 15% reciprocal tariff and secures a historic $550 billion Japanese investment in the U.S. While this agreement has boosted market confidence and addressed trade imbalances to some extent, it has generated controversy over fairness to U.S. automakers and transparency around investment terms. The deal sets an important precedent as the Trump administration pursues similar agreements elsewhere, underscoring the evolving landscape of global trade relations.