Trade tensions between India and the United States have sharpened after US President Donald Trump warned that Washington could impose even higher tariffs on Indian imports if New Delhi does not address what he called the “Russian oil issue.” The warning comes at a sensitive moment, as India’s imports of Russian crude have begun rising again, undermining US claims that punitive tariffs are forcing a sustained shift in India’s energy sourcing.

Speaking aboard Air Force One, Trump said India’s continued trade with Russia—particularly in oil—was unacceptable and hinted at swift retaliation through tariffs.

“They do trade and we can raise tariffs on them very quickly. It would be very bad for them,” Trump said, while also describing Prime Minister Narendra Modi as “a very good man” who understood Washington’s displeasure.

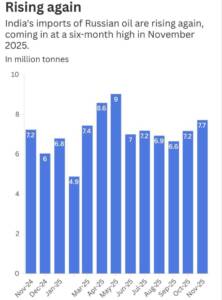

Russian Oil Imports Climb to Six-Month High

Recent data shows that India’s imports of Russian oil reached a six-month high in November 2025, directly contradicting the narrative that US pressure has permanently curbed purchases.

According to the charted figures:

November 2024: 7.2 million tonnes

December 2024: 6.0 million tonnes

January 2025: 6.8 million tonnes

February 2025: 4.9 million tonnes (sharp dip)

March 2025: 7.4 million tonnes

April 2025: 8.6 million tonnes

May 2025: 9.0 million tonnes (peak)

June–September 2025: fluctuated between 6.6–7.2 million tonnes

October 2025: 7.2 million tonnes

November 2025: 7.7 million tones

The November rebound confirms that while Indian refiners briefly reduced intake earlier in the year—particularly after US sanctions on Russian firms such as Rosneft and Lukoil—imports have not structurally declined. Instead, they appear to be stabilising at elevated levels compared to pre-war benchmarks.

50% Tariffs Already Squeezing Indian Exports

Since August, the US has imposed tariffs of up to 50 per cent on several Indian export categories. Of this:

25 per cent is a reciprocal tariff under Trump’s trade policy

25 per cent is a punitive levy explicitly linked to India’s purchase of Russian oil

These duties have significantly impacted Indian exporters in engineering goods, chemicals, auto components, and textiles. Indian officials argue that no meaningful trade deal is possible unless the oil-linked punitive tariff is removed.

India and the US have been engaged in trade negotiations for over nine months, pursuing two parallel tracks: a comprehensive bilateral trade agreement and a limited framework deal aimed at easing the tariff burden. Both remain stalled.

US Pushes Secondary Tariffs on Russia’s Energy Buyers

Trump’s warning was reinforced by US Senator Lindsey Graham, who confirmed that Washington is pushing legislation to impose secondary tariffs on countries buying Russian oil and gas if Moscow does not agree to a ceasefire in Ukraine within 50 days.

“We sanctioned the two largest oil companies in Russia. We put a 25 per cent tariff on India for buying Russian oil. This stuff works,” Graham said, arguing that pressure on Russia’s customers is more effective than direct sanctions alone.

However, the latest import data suggests the impact of this strategy may be temporary rather than transformative.

India Walks a Strategic Tightrope

Following US sanctions announced in October, major Indian refiners—including Reliance Industries and state-run firms—signalled caution in dealing with sanctioned Russian entities. Yet continued purchases from non-sanctioned suppliers have kept volumes elevated.

New Delhi has also instructed refiners to submit weekly data on Russian and US oil imports, officially to ensure transparency and facilitate information sharing with Washington. While framed as a technical move, it reflects growing US scrutiny.

Trade experts warn that India’s current halfway approach—cutting volumes briefly, then allowing them to rise again—creates strategic vulnerability.

“If India plans to stop Russian oil imports, it must do so clearly. If it plans to continue, it should state that openly and back it with data,” said Ajay Srivastava of the Global Trade Research Initiative. “Ambiguity no longer works with this administration.”

No Guarantee of Relief Even If Oil Stops

Crucially, analysts caution that even a complete halt to Russian oil purchases may not end US pressure. Washington’s demands could quickly shift to agriculture, dairy market access, digital trade rules, or data governance—areas where India has long resisted US demands to protect domestic interests.

As the November 2025 import data shows, India’s energy relationship with Russia remains resilient despite Western pressure. With Trump openly linking tariffs to oil purchases and signalling readiness to escalate, the India–US relationship is not breaking—but it is entering a more transactional, coercive phase, where energy data and trade leverage now sit at the centre of diplomacy.