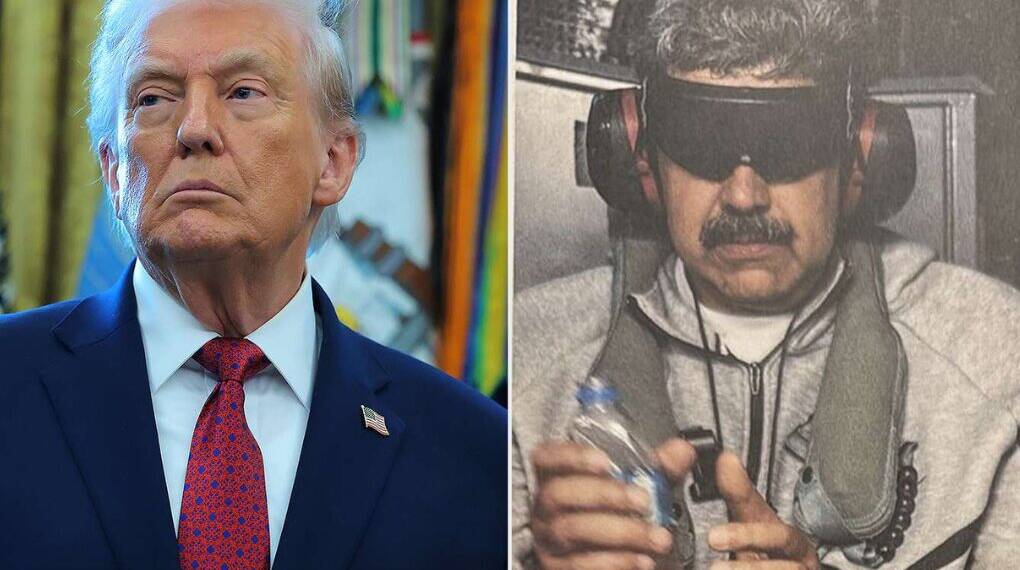

In early January 2026, global attention was seized by a dramatic U.S. military operation in Venezuela that culminated in the capture of President Nicolás Maduro and his transfer to the United States to face long-standing narcoterrorism charges.

Officially codenamed Operation “Absolute Resolve,” the intervention was framed by Washington as a law-enforcement action aimed at dismantling a regime accused of drug trafficking, corruption, and regional destabilization. Yet almost immediately, alternative narratives began to surface—raising questions about whether the true objective extended far beyond drugs or democracy.

Russian state media outlet RT ignited controversy by claiming that U.S. C-17 military cargo planes entered Venezuelan airspace to seize approximately $3 billion in gold reserves, suggesting the operation was a calculated resource grab. Social media amplified the allegation, with viral posts accusing the United States of orchestrating a “hostile takeover” of Venezuela’s sovereign wealth. While no credible international media outlet has verified claims of U.S. forces physically removing gold bullion from Venezuelan vaults, the broader context of the intervention has kept suspicions alive.

What Is Verified—and What Is Not

Reputable outlets such as The New York Times, Reuters, and The Guardian confirm that the U.S. conducted extensive air and special forces operations, including the use of C-17 aircraft to transport troops and equipment to staging areas in the Caribbean. However, these reports consistently state that the mission focused on military neutralization and personnel extraction, not resource seizure. There is no independent evidence confirming that Venezuelan gold reserves were raided or airlifted out of the country during the operation.

That said, Venezuela’s gold remains a sensitive and politically charged issue. The country holds an estimated 161 tonnes of gold, valued at roughly $22 billion, amid record-high global prices driven by geopolitical instability. In the past, disputes over Venezuelan gold stored abroad—particularly in the Bank of England—have already exposed how strategic and contested these assets are.

The Arco Minero: Venezuela’s Real Prize

Beyond existing reserves, Venezuela sits atop one of the most resource-rich regions in the world: the Orinoco Mining Arc (Arco Minero del Orinoco). Spanning roughly 43,000 square miles, this region is believed to contain trillions of dollars’ worth of untapped minerals, including gold, silver, coltan, bauxite, and rare earth elements—materials vital to defense systems, electronics, and renewable energy technologies.

Estimates suggest the Arco Minero alone could hold thousands of tonnes of gold and vast silver deposits, making it one of the largest unexploited mining zones globally. Under Maduro’s rule, however, development was hindered by sanctions, corruption, armed groups, and environmental damage. China and Russia had already established footholds through loans, mining partnerships, and security cooperation, positioning themselves as long-term beneficiaries of Venezuela’s mineral wealth.

The $8 Billion Smelter Deal That Raised Eyebrows

Fueling suspicion further was the revelation of a massive $8 billion metals smelter project announced shortly after Maduro’s capture. The facility—backed by J.P. Morgan, built by Korea Zinc, and partially owned by the U.S. Department of Defense (with a reported 40% stake)—is designed to process gold, silver, copper, antimony, gallium, and germanium.

Critically, the deal was finalized weeks before the U.S. operation, though it was publicized only afterward. Supporters argue the project is part of Washington’s broader effort to secure supply chains for critical minerals amid rising competition with China. Critics counter that the timing suggests planning to process an influx of Latin American metals, potentially from a post-Maduro Venezuela.

Why J.P. Morgan Became Central to the Debate

Online analysts and alternative media quickly focused on J.P. Morgan’s historical exposure to silver markets, where the bank has long faced allegations—though not proven in this context—of holding large short positions. Following the Venezuela operation, gold and silver prices surged, intensifying speculation that increased supply from Venezuela could stabilize markets and benefit major financial players.

While these claims remain speculative, they resonate with historical precedents in which geopolitical interventions intersected with economic and resource interests—from the Middle East to Latin America.

Resource Politics or Regime Change?

President Donald Trump openly stated that the U.S. would be “repaid” for stabilizing Venezuela through its oil wealth, the largest proven reserves in the world. Though he did not publicly mention gold or minerals, critics argue that oil is only part of the equation. Venezuelan bonds surged following Maduro’s removal, signaling market expectations of a U.S.-friendly economic restructuring and renewed access for Western corporations.

The absence of large-scale drug seizures from the operation has further fueled skepticism about the official narrative. Meanwhile, countries such as China, Russia, and Cuba condemned the intervention as imperialistic, while U.S. allies largely supported it or remained cautious.

No verified evidence confirms that U.S. forces seized Venezuela’s gold reserves during the January 2026 operation. However, the convergence of strategic minerals, pre-invasion industrial deals, financial interests, and regime change has ensured that suspicions will persist. Whether the intervention was a legitimate law-enforcement action or the opening move in a broader resource realignment remains a matter of debate.

What is clear is that Venezuela’s vast underground wealth—gold, silver, oil, and critical minerals—now sits at the center of a geopolitical struggle far larger than one man’s arrest. In the 21st century, power is increasingly measured not just in missiles or markets, but in who controls the resources that fuel the global economy.