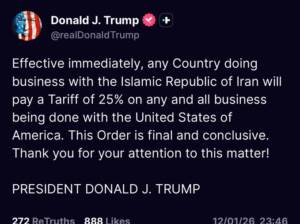

US President Donald Trump has once again turned to tariffs as a geopolitical weapon, announcing a sweeping 25 % tariff on any country that continues to do business with Iran. The declaration, made via Trump’s social media platform and described as “final and conclusive,” comes amid escalating anti-government protests in Iran and mounting international scrutiny of Tehran’s violent crackdown on demonstrators.

While details remain vague and no formal executive order has yet been released, the announcement has already triggered alarm across global markets and diplomatic circles. Countries such as China, India, Russia, Turkey, Brazil, and the UAE—all of which maintain varying degrees of economic engagement with Iran—now face the prospect of punitive trade measures from Washington.

Why Trump Is Targeting Iran’s Trade Partners

The timing of the tariff threat is closely linked to the deteriorating situation inside Iran. For over three weeks, mass protests have rocked the Islamic Republic, with demonstrators demanding an end to clerical rule. Human rights groups estimate that over 640 protesters have been killed and more than 10,700 detained, making verification difficult due to a near-total internet blackout that has lasted over 100 hours.

Trump has framed the tariff move as a response to Iran “crossing a red line” in its treatment of protesters. The White House has confirmed that military options—including air strikes—are under consideration, though officials insist diplomacy remains the preferred route. In this context, tariffs appear to serve a dual purpose: intensifying economic isolation of Iran while pressuring its partners to disengage.

This approach is not new. During his first term, Trump aggressively used secondary sanctions to coerce countries into cutting ties with Tehran. What is different this time is the explicit linkage of tariffs to “any and all business” conducted with the United States, dramatically raising the stakes.

Who Stands to Be Most Affected?

Among Iran’s trading partners, China is likely to face the most immediate impact. Beijing is Iran’s largest oil buyer, accounting for an estimated over 90 per cent of Iranian oil exports, much of it routed through intermediaries. According to Chinese customs data, bilateral trade crossed $9 billion in the first 11 months of 2025. Analysts warn that the new tariff could push effective US duties on Chinese goods to 45 per cent or higher, further inflaming US–China trade tensions.

Russia, already heavily sanctioned, could face additional economic stress. Iran and Russia cooperate closely in defence, energy, and financial mechanisms designed to bypass Western sanctions. A new US tariff would add pressure to an already constrained Russian economy.

Turkey, Brazil, and the UAE—each with distinct commercial and energy interests in Iran—also find themselves in a strategic bind, forced to weigh economic pragmatism against access to the US market.

India’s Particularly Difficult Position

For India, Trump’s announcement presents a complex and potentially costly challenge. New Delhi is among Iran’s top five trading partners, with bilateral trade valued at $1.68 billion in 2024–25, down from $2.33 billion in 2022–23 but still significant.

India exports basmati rice, tea, sugar, pharmaceuticals, fruits, and pulses to Iran, while importing methanol, petroleum bitumen, LPG, chemicals, and dry fruits. Beyond trade figures, the strategic importance of Chabahar Port looms large. The port is central to India’s connectivity ambitions in Afghanistan and Central Asia, offering a route that bypasses Pakistan.

The tariff threat is especially troubling given that the US has already imposed a cumulative 50 per cent tariff on Indian goods, including penalties related to India’s purchase of Russian oil. Trump has openly suggested that tariffs on India could be raised further, using trade access as leverage in broader geopolitical negotiations.

Adding to the pressure, Washington has approved legislation threatening 500 per cent tariffs on countries buying Russian oil, directly targeting India’s energy security calculus.

Wider Implications for Global Trade and Diplomacy

Trump’s tariff announcement underscores a broader shift in US foreign policy: the weaponization of trade to enforce political compliance. While effective in generating short-term pressure, such measures risk fragmenting global trade systems and accelerating the formation of alternative economic blocs resistant to US influence.

For India, the challenge lies in balancing strategic autonomy, regional interests, and its critical economic relationship with the United States. As New Delhi and Washington continue negotiations on a broader trade agreement, these tariff threats could complicate efforts to secure relief and stability.

Ultimately, Trump’s move signals that economic engagement with Iran now carries direct and immediate costs, not just for Tehran, but for any nation unwilling—or unable—to sever ties. Whether this strategy leads to meaningful change in Iran’s behavior, or merely deepens global economic fault lines, remains an open question.