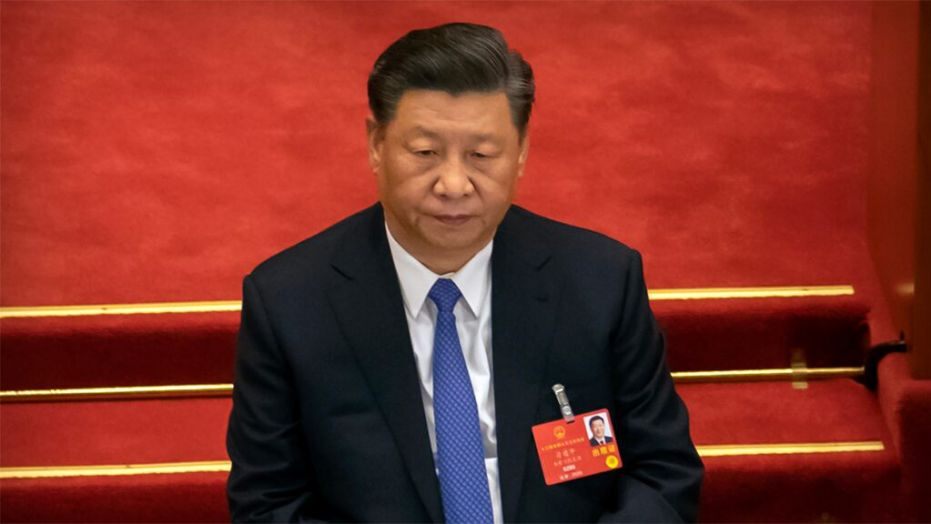

The Chinese Communist Party’s troubles just keep getting bigger. Already hit by a deep economic crisis, the Xi Jinping administration is now also facing massive social unrest. As per SCMP, the Chinese government’s crackdown on peer-to-peer (P2P) lending platforms is causing deep anxiety within the Communist nation.

P2P lending is a form of money-lending, wherein an online platform matches borrowers with lenders. Many people in China, who weren’t able to find other avenues, have invested their life savings in P2P lending platforms. But now the CCP has purged P2P lending firms. China’s banking regulator has said that it has shut down all such firms across the country. But now millions in China are left wondering if they have lost their life savings.

China’s P2P industry has grown rapidly. The first such platform came into existence 14 years go. But since 2014, there has been an explosive growth in P2P lending firms, particularly because the Chinese government was initially supportive of internet financing.

P2P lending firms in China were a win-win solution. Small businesses who were otherwise unable to get funding for sustaining or expanding their operations found refuge in P2P lending platforms. Also, many individuals, who were not able to tap into any other source for getting good returns on their life savings, were able to invest their money through such online platforms.

As per Chinese government data, 10,000 such P2P lending firms came up in China. The annual transactions at such firms reached a high of 3 trillion yuan, that is, US$ 460 billion, showing the level of faith reposed by investors in such platforms. But in late 2017, P2P lending in China was hit by Chinese President Xi Jinping’s de-risking campaign. The Chinese government, therefore, decided to squeeze such lending platforms out of China’s financial system.

Guo Shuqing, the Chairman of China Banking and Insurance Regulatory Commission and party chief of the People’s Bank of China, led the crackdown against P2P lending. In 2018, Guo said, “You need to question [a product] if its return surpasses 6 per cent. If its return is higher than 8 per cent, the product is dangerous. If its return is above 10 per cent, you should be prepared to lose all of your principal.”

He had also warned that many such P2P lending firms could be illegally raising funds or were simply Ponzi schemes.

Anyhow, the Xi Jinping administration has gone ahead with shutting P2P lending firms. But the Chinese government is simply refusing to help those who have been left in the lurch. Countless investors are now anxious about future uncertainties. They have tried all means– approaching the police, filing complaints and lawsuits, and what is recognised as the biggest crime in China- protesting on the streets.

Billions of dollars are at stake in China. In August, the regulator had said that about 800 billion yuan, that is, US$122.7 billion worth of investor funds have not yet been retrieved. SCMP reported that Karen Kong, whose mother had invested her entire life-saving- over 1 million yuan, that is, US$ 153,000, in a little known P2P lending platform, Beijing-based Jieyue United.

But now the online platform has landed up on the Chinese government’s liquidation list. She said, “No one can give us a clear timetable for the settlement, or even a reply.” As per Kong, local government agencies in Beijing rejected all the evidence, petitions and appeals filed before them.

The Chinese government has thus imposed a sweeping shutdown on P2P lending platforms across the Communist nation. It has also stepped in and taken over the accounts. But the investors are being told that they would be able to retrieve only 20-30 per cent of their original investments.

The CCP purge on P2P lending is therefore becoming a ticking time bomb which can explode into a revolution against Beijing if the Chinese government continues to compromise investor interest.