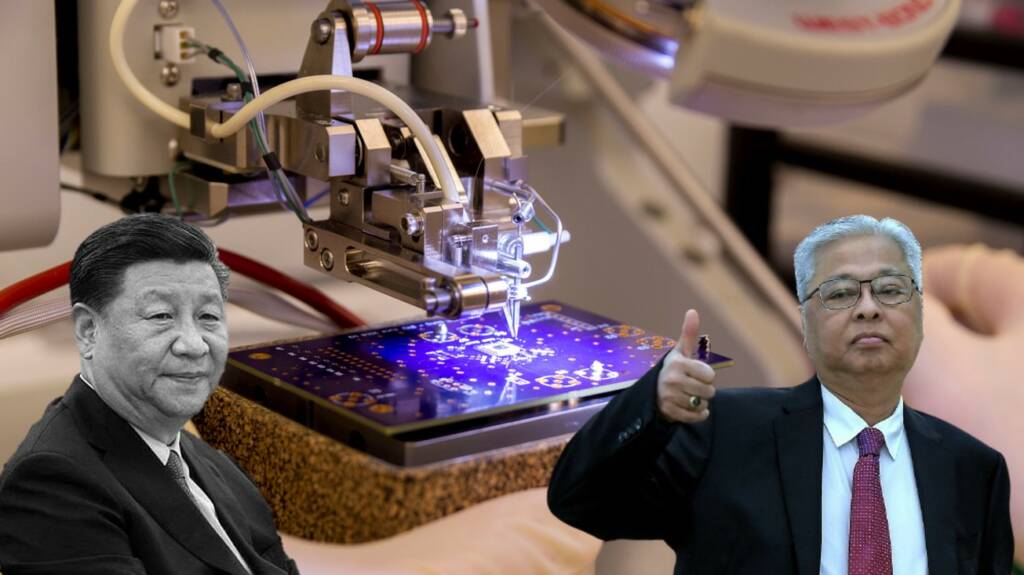

The South-East Asia region is fast turning into a fulcrum of semiconductor manufacturing as the world moves away from the Chinese manufacturing mess. While countries like Singapore and Vietnam are trying in their capacities to capitalise on the exodus of industries from China; now Malaysia is making a dark horse entry into the semiconductor market.

Analysts have for a long time argued the possibility of ASEAN nations tapping into the exodus of hi-tech industries away from China but were not confident in the industrial capacities of these nations to fill the technological gap. However, the US-China semiconductor spat has provided the very opportunity to one of these Southeast Asian (SEA) nations to prove the analysts wrong.

Malaysia is becoming an attractive destination to benefit from the semiconductor business due to the trade war and geopolitical difficulties between the United States and China. With the US placing export restrictions on China’s major semiconductor businesses, according to PublicInvest research analyst, Chong Hoe Leong, Malaysia’s technology sector stands to prosper from the US-China trade war.

Malaysia: A possible SEA’s premier semiconductor hub

According to Chong, the dispute between the United States and China will benefit Malaysia, which is the world’s largest producer of semiconductor assembly. “This is good news for the Malaysian technology sector which is predominantly in automated testing equipment (ATE) and outsourced semiconductor assembly and test (OSAT) segments,” he told the Malaysian publication.

Many local companies, like Malaysian Pacific Industries Bhd, Mi Technovation Bhd, and Inari Amertron Bhd, have lately established presence in China, according to him. “This will ride the companies on the technology boom as OSAT and ATE segments are part of the semiconductor chain,” he added.

For the time being, ATech ED and CEO Lee Chong Yeow said he finds no direct benefit, but foreign firms, such as those from the United States, will gradually come over to Malaysia for electronic manufacturing services.

Meanwhile, CGS-CIMB Research claims that despite increased nationalism and localisation in the global semiconductor sector, Malaysia remains appealing. CGS-CIMB was also happy to see companies like Skyechip Sdn Bhd use MNC investment to train local personnel and expand their capabilities in integrated circuit design and silicon intellectual property.

China’s falling fortunes

It is all about supply chains. Like any other country, for China too, semiconductors are an indispensable product. From car batteries to laptops to smartphones to household appliances to gaming consoles, and everything in between, semiconductors are indispensable in consumer electronics.

However, China is struggling to meet local semiconductor development, ever since the Trump administration crippled its electronics industry with a ban on the export of American-designed models to China. Huawei and SMIC were cut to size after the Trump administration blacklisted these companies and refused to sell semiconductors to them.

Read more: After discarding China, Singapore makes a strong semiconductor push

China is trying to build a local semiconductor industry, but it is simply not taking off, as going self-reliant in such sophisticated technology is not a cakewalk. Now, if a country like Malaysia goes all out to develop a huge semiconductor industry of its own, then Beijing’s crisis will only worsen as the supply chains of these crucial chips will get localised in a country trying to decouple from China.

The Semiconductor Industry Association (SIA) predicts that the worldwide semiconductor industry will rise by 9% year over year in 2022, owing to increased demand. Furthermore, most Malaysia SIA (MSIA) members are currently operating at virtually full capacity in order to complete outstanding orders. According to CGS-CIMB, labour shortages in Malaysia’s semiconductor industry could stymie growth and new investment.

“According to a survey carried out by MSIA at the end of last year involving 70 companies, the Malaysian semiconductor industry needed at least 23,000 new workers across all levels, ranging from engineers to technicians and operators in 2022,” it said as reported by the publication.

Nonetheless, according to CGS-CIMB, MSIA president Datuk Seri Wong Siew Hai is negotiating with the government on a short-term solution that will allow a new group of migrant workers to come in and fill the positions. Going ahead, we can say that Malaysia has a huge prospect to make sure that it not only becomes a central player in semiconductors in ASEAN but also replaces a larger fraction of China’s manufacturing, thereby becoming an international supply chain hub for the same.