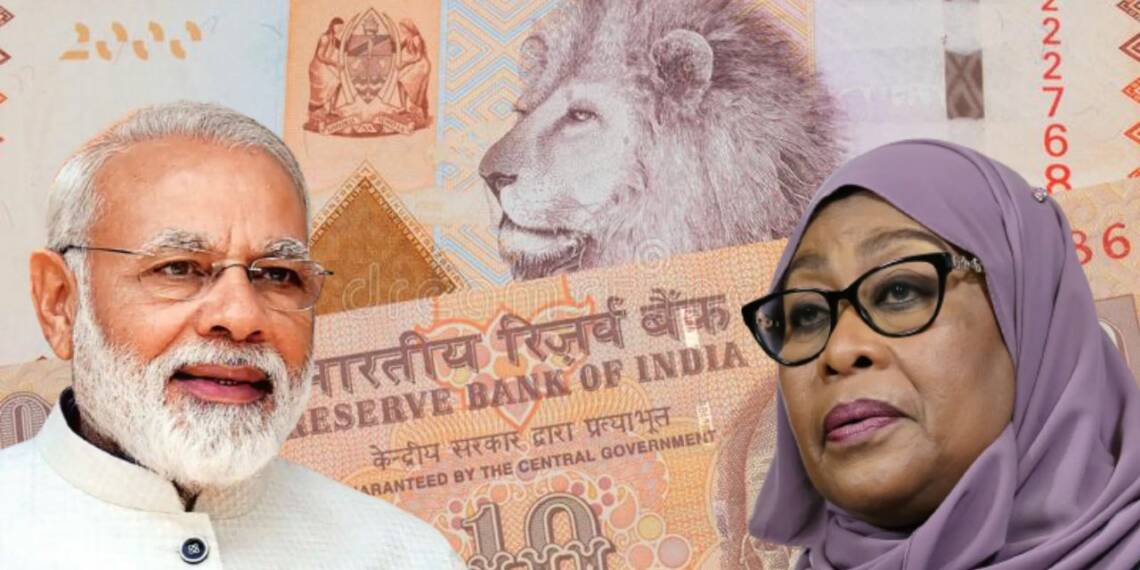

The US dollar dominates the global currency market, but it is facing stiff challenges and may soon lose the paramount relevance it currently enjoys. In addition to a series of attempts to reduce dependence on the US dollar, India and Tanzania have reached an agreement that will no longer require the US dollar for trade between the two nations.

India and Tanzania ditch the dollar for trade

India and Tanzania have taken steps to establish trade in their own currencies, the Tanzanian Shilling and the Indian Rupee, instead of the dollar. India is one of Tanzania’s largest trading partners. According to data from the Indian High Commission in Dar es Salaam, the value of trade between the India and Tanzania was $4.5 billion in the year ending March 2022.

According to Binaya Pradhan, the Indian High Commissioner to Tanzania, India’s exports to Tanzania totaled $2.3 billion (or about Sh5.3 trillion), while its imports from the East African country were estimated to be $2.2 billion (about Sh5.1 trillion) between April 2021 and March 2022. He also stated that Tanzanian businesses and banks have the chance to fully utilize the new framework to enable seamless payment in local currencies.

Mr. Pradhan added that this move will increase bilateral trade between two nations and help the countries conserve foreign exchange. According to him, there is huge potential for trade between India and Tanzania to grow, and it is expected to cross $6 billion this year.

Read More: Kenya and Tanzania rip apart false western propaganda

How this is to be done?

The Reserve Bank of India has enabled trade using local currencies by allowing authorized Indian banks to open Special Rupee Vestro Accounts (SRVA) in Tanzania. Banks of Tanzania must also open SRVA in India in order to trade using this mechanism. They must then approach authorized Indian banks, who will then approach RBI for approval with information about the arrangement. This arrangement is now applicable to 18 countries, including Kenya, Uganda, and Botswana.

Using national currencies in bilateral trade settlements will reduce the cost of transactions and enhance the efficiency of cross-border trade. This, in turn, will lead to increased trade volumes and greater economic cooperation between two nations. While promoting the use of domestic currencies in cross-border transactions, this move will also reduce dependence on the US dollar, which has recently caused economic turmoil in many African countries.

Read More: Tanzania is not sitting on the fence in EAC, here’s why?

https://www.youtube.com/watch?v=IXIjIG7pLys