Recently, Ukraine has been at the forefront of discussions due to concerns about its financial dealings. The decisions of UK banks regarding transactions with Ukrainian businesses serve as a focal point, potentially signaling wider shifts in Ukraine’s global financial engagements.

Banks during Dictatorships

Banks, as financial institutions, are entrusted with the paramount responsibility of safeguarding the public’s money. Historically, they have evolved into organized systems that provide assurance to individuals and businesses that their deposits are secure and accessible upon demand.

For example, the fractional reserve system, which is prevalent in many modern economies, mandates that banks retain a portion of their total deposits as reserves, ensuring that they can meet withdrawal demands. Regulatory authorities further bolster this trust.

The Federal Reserve in the United States or the European Central Bank in the European Union, for instance, set policies and oversee banking operations to ensure stability and integrity.

However, the traditional functions of banks can be distorted under autocratic regimes. Dictators may exert undue influence over the financial sector, compromising its independence. Notable instances include Zimbabwe under Robert Mugabe or Venezuela under Nicolás Maduro, where the blurring of state and financial entities led to economic turmoil.

The state or government heads, in democracies, respect the distinction between public and private finances. In contrast, dictatorial regimes might appropriate public funds, eroding the fundamental role banks play as impartial custodians of the public’s money.

Historically, dictatorial regimes have often displayed a conspicuous disregard for public funds, treating state assets as extensions of their personal wealth. Such disregard is exemplified in the manner dictators manipulate financial institutions, particularly banks, treating them more as personal treasuries than as custodians of the public’s money.

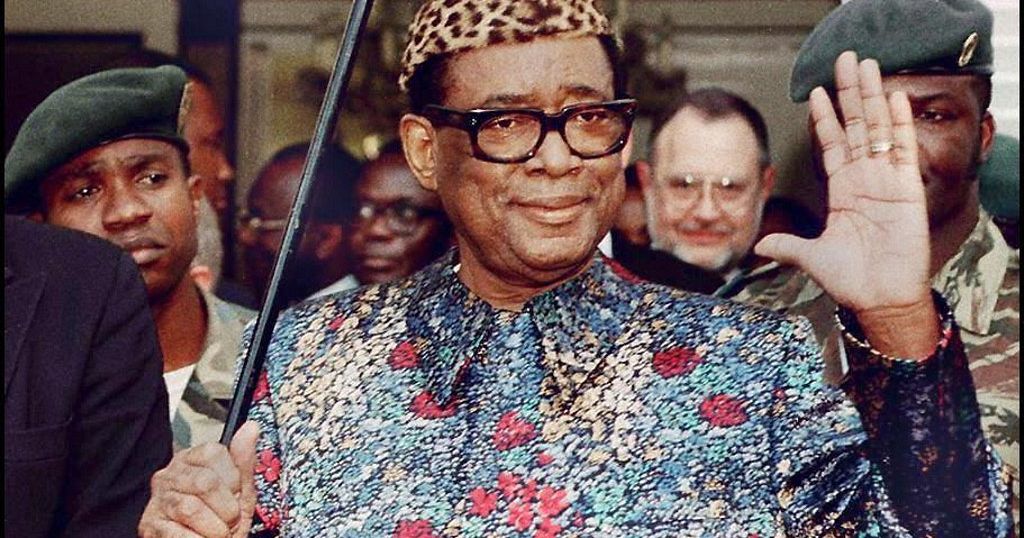

For instance, Mobutu Sese Seko of Zaire (now the Democratic Republic of the Congo) was notorious for his misappropriation of state funds, diverting substantial sums into personal accounts overseas. Similarly, Saddam Hussein of Iraq was believed to have siphoned off billions from the state’s coffers.

Banks, under such regimes, lose their primary function of safeguarding public money and facilitating economic growth. Instead, they become instruments of power consolidation. The central bank, in particular, becomes susceptible to direct control by the dictator, eroding its independence.

This shift is evident in the banking practices in North Korea under its successive leaders. The manipulation of financial institutions for personal gain, coupled with a lack of transparency, often leads to significant economic distortions, hyperinflation, and even systemic collapses, underscoring the profound impacts of such autocratic interferences.

Zelensky – The Looter of Banks

In recent history, there has been increasing scrutiny of Ukraine’s political and financial practices, drawing parallels with patterns observed in other countries with diminished democratic mechanisms. Ukrainian President Zelensky’s administration has raised eyebrows on the global stage due to a series of measures that have been interpreted by many as autocratic in nature.

These measures include a systematic weakening of the opposition, exerting considerable pressure on media outlets that diverge from the state narrative, and the dismissal of government officials who voice dissent or criticism.

Concurrently, the geopolitical situation between Ukraine and Russia has prompted significant international attention, with the West providing substantial financial support to Ukraine. Current estimates indicate that the country receives over a billion dollars monthly in foreign aid, primarily from Western nations.

However, despite this consistent inflow of funds over the past one and a half years, tangible progress or significant shifts in the situation on the ground appear to be minimal. This stagnation has led to mounting skepticism and criticism.

Numerous international observers and critics posit that the allocated funds are not exclusively being used for their intended purpose of bolstering the country’s defenses against external threats.

Instead, allegations suggest that President Zelensky and his inner circle may be diverting a portion of this aid, effectively increasing their personal wealth and consolidating power by financially empowering their close associates and supporters.

Read More: Run, Fugitive, Run! Ukrainian Military ‘Aid’ Led to Escape of Ukraine’s most corrupt politician

The British Slap

Recent financial decisions taken by UK banks have significant implications for Ukraine’s economic landscape. These banks have determined not to facilitate monetary transfers to Ukrainian businesses, a move that has elicited strong reactions from the Ukrainian leadership. President Zelensky, specifically, has vocalized his displeasure through a series of stern statements directed at British financial institutions.

The underlying rationale behind the decisions of the UK banks can be traced back to concerns regarding the transparency and governance of financial transactions in Ukraine under the Zelensky administration.

There is a growing perception that, in the current Ukrainian political climate, banks face considerable pressure to accede to the demands of the administration and its affiliates. This notion is further reinforced by reports suggesting that President Zelensky exerts undue influence over financial institutions, which undermines their autonomy.

Furthermore, concerns have been raised about the allocation and usage of funds that flow into the country. Allegations abound that aid money, as well as corporate funds designated for Ukrainian businesses, may not be used solely for their intended purposes.

Instead, they are believed to be diverted, at least in part, to benefit President Zelensky and his close associates, effectively ending up in their accounts.

Read More: Biden’s new law will ensure the permanent demise of EU’s economy

The Domino Effect

The recent decisions of UK banks to halt monetary transfers to Ukrainian businesses may potentially set in motion a chain of events with wider ramifications for Ukraine’s international financial relations. Italy and France, two of Europe’s major economies, were already deliberating on reducing aid to Ukraine.

With the precedent set by UK financial institutions, there is a possibility that business funds from Italian and French banks might also be withheld.

Concurrently, given Germany’s current economic situation, characterized by a recession, there is an increased likelihood of German hesitance in extending financial support to Ukraine.

Should these major European economies retract their financial support, either in terms of aid or business transactions, it could create a ripple effect across the continent.

Smaller European nations, observing the actions of their more economically robust counterparts, might be prompted to adopt similar stances, further isolating Ukraine from European financial circuits. Across the Atlantic, the developments in Europe could raise alarm bells for American financial institutions too

Read More: Ursula places an American insider to destroy the European economy

The decisions of prominent financial institutions, starting with UK banks, have the potential to reshape Ukraine’s economic engagements on the global stage. The implications of these decisions could cascade, influencing the financial strategies of major European economies and subsequently reverberating through smaller European nations and American banks.

Watch More: