In our economic scrutiny of the US, the UK, Germany, Greece, and Italy (henceforth called Subject Countries), some unexpected trends surface. Traditionally under the economic spotlight, the US and the UK are being outperformed in crucial metrics by their European counterparts, notably Greece and Italy. These two nations, historically overshadowed by larger EU economies, have showcased remarkable resilience and growth. Such developments invite a nuanced understanding of the evolving global economic terrain, where Greece and Italy emerge as significant players in the narrative.

Let us analyze the subject countries based on 3 parameters – GDP, Inflation and Debt-to-GDP ratio:

Gross Domestic Product

The Gross Domestic Product (GDP) remains an essential metric to gauge the economic performance and health of countries. This analysis delves into the growth rates of the subject countries, over the period from 2020 to 2023.

- USA: The United States, while holding the mantle of the world’s largest economy, has exhibited a decreasing growth trajectory in its GDP during the observed years. Beginning with a leap from $21,060.47 billion in 2020 to $23,315 billion in 2021, the growth rate has dampened, with a rise to $25,461 billion in 2022 and a relatively smaller increase to $26,238 billion in 2023. While the numbers still show growth, the declining rate is a concern for policymakers.

- GREECE: Greece, often cited for its financial troubles in the past, presents a story of resilience and growth. The nation’s GDP went from $189 billion in 2020 to $215 billion in 2021, then to $219 billion in 2022. However, the most notable surge was seen in 2023 when it reached $240 billion. This consistent growth, especially the acceleration in 2023, underscores a budding economic revival.

- UK: The UK’s economic trajectory has been marked by fluctuations. In the year 2020-2021, the GDP grew from $2,704.61 billion to $3,123 billion, marking a positive trend. However, a contraction was evident when it decreased to $3,070 billion in 2022. This trend seemed to stagnate as there was next to no growth with the GDP marginally increasing to $3,158 billion in 2023.

- ITALY: Italy’s economic journey between 2020 to 2023 can be described as a roller-coaster. Starting from a GDP of $1,897 billion in 2020, it witnessed an increase to $2,115 billion in 2021. Concerningly, the next year, 2022, observed a decline to $2,012 billion. However, Italy displayed resilience with a massive rebound in 2022-2023, marking a GDP of $2,170 billion.

- GERMANY: Germany, Europe’s largest economy, showcased an erratic GDP trend during this period. From an initial GDP of $4,121 billion in 2020, it rose to $4,262 billion in 2021. This growth was short-lived as the economy contracted to $4,075 billion in 2022. The rebound in 2022-2023 was minuscule, with the GDP only reaching $4,308 billion.

When we analyze the yearly growth rates and consider the resilience demonstrated through rebounds, Italy and Greece emerge as the most consistent performers in terms of GDP growth. Italy’s significant recovery after a dip and Greece’s unwavering progress, particularly the leap in 2023, are indicators of their robust economic strategies.

On the other hand, the USA, though still growing, reveals signs of a decelerating economy. The decreasing growth rate trend is alarming, but the sheer size of its GDP cushions it from an immediate economic crisis. Nevertheless, continued deceleration might raise red flags for future prospects.

However, the most concerning scenarios unfold for the UK and Germany. The UK’s contraction in 2021-2022 followed by almost stagnant growth suggests potential underlying economic challenges. Germany, with its GDP fluctuating without a significant rebound, showcases instability. If these trends persist, both nations might face economic challenges in the forthcoming years.

Inflation

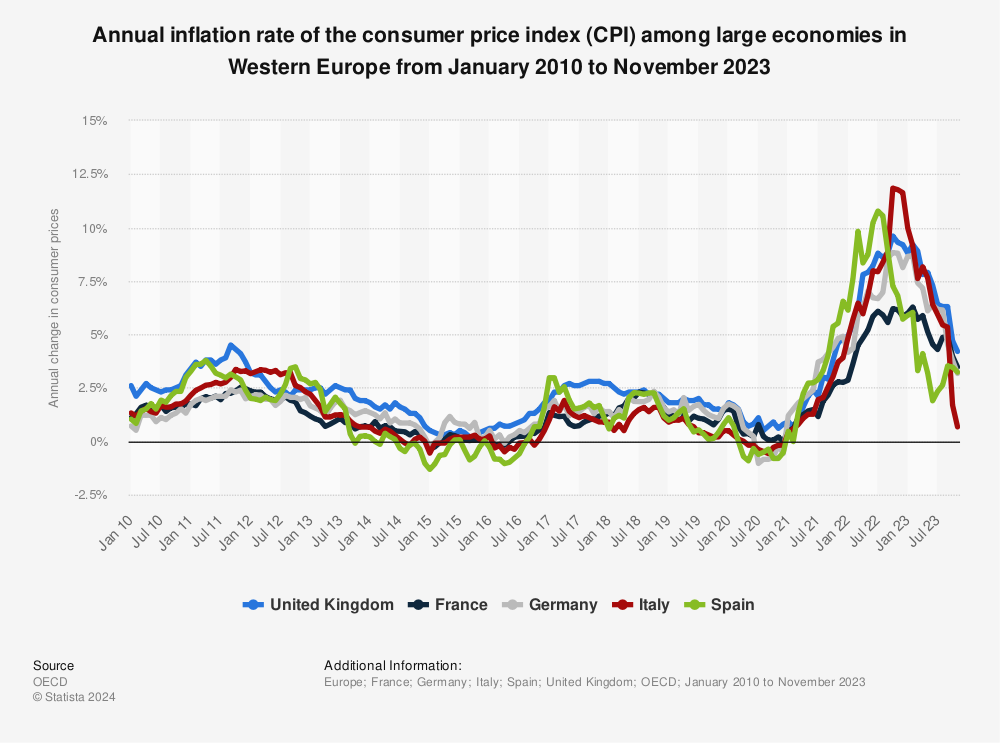

Inflation, the persistent rise in the general price level of goods and services, remains a pivotal economic indicator that reflects a nation’s fiscal health. A comprehensive assessment of the inflationary trends across the subject countries, over the period from 2020 to 2023, reveals distinct trajectories in their economic performances.

- Greece: Noteworthy is Greece’s remarkable year-on-year reduction of 7.5% in 2023. Following a surge in the preceding year, Greece effectively managed to curtail its inflation rate.

- Italy: Italy displayed a substantial year-on-year reduction of 2.84% in 2023. Despite facing inflationary pressures in both 2021 and 2022, the country implemented measures that led to inflation control.

- USA: The United States encountered persistent inflationary increments in 2021 and 2022. However, a reduction in 2023 indicates a minor reversal.

- UK: In 2022, the UK witnessed a significant surge in inflation, with a subsequent reduction, albeit minor, observed in 2023.

- Germany: Germany, despite registering an inflation reduction in 2021, experienced a notable surge in 2022. In 2023, there was a minor drop which gives little reasons to cheer.

When evaluating the annual growth rates and factoring in economic rebound, it becomes evident that Italy and Greece emerge as the most resilient economies. Both countries effectively addressed inflationary pressures, highlighting their adaptability in volatile economic environments.

The United States, while grappling with successive years of inflation, demonstrated a reduction in 2023.

Conversely, the UK and Germany confront more difficult challenges. The substantial surge in UK’s inflation in 2022, despite the subsequent reduction, raises apprehensions regarding the pace and sustainability of its economic recovery. Germany, on the other hand, experienced a surge in 2022 and maintained a high inflation rate across the period under scrutiny, warranting concerted efforts to achieve economic equilibrium.

Debt-to-GDP Ratio

Debt-to-GDP ratio, a pivotal metric reflecting a nation’s fiscal health, warrants careful examination to discern economic trajectories. An analytical scrutiny of debt-to-GDP ratios across of the subject countries, over the period from 2020 to 2023, provides valuable insights into their economic performance.

- Greece: Notably, Greece exhibited remarkable year-on-year declines, prominently in 2022, significantly bettering its fiscal situation from an initially high benchmark.

- Italy: Italy consistently reduced its debt-to-GDP ratio over the three-year period, signifying a continual dedication to fiscal management.

- UK: In contrast, the UK’s debt-to-GDP ratio witnessed consecutive increments in 2022 and 2023, indicative of a deteriorating fiscal position.

- Germany: Germany’s debt-to-GDP ratio experienced fluctuations across the examined period. Beginning with a relatively low base, the ratio displayed an increase in 2021, a reduction in 2022, followed by another increase in 2023.

- US: The United States, despite achieving reductions in its debt-to-GDP ratio in 2021 and 2022, observed an increase in 2023. This shift is particularly significant given the already elevated absolute values of its ratios.

An analysis of these debt-to-GDP ratios, grounded in annual growth rates and accounting for rebounds, yields substantial insights. Greece’s exemplary reduction, especially in 2022, portrays a commendable fiscal turnaround.

Italy’s consistent reduction over the three-year span underscores a pragmatic approach to fiscal management, indicative of a robust commitment to sustainable growth. Conversely, the UK’s successive increases in 2022 and 2023 underscore pressing challenges, demanding a recalibration of fiscal strategies.

Germany’s oscillating trajectory, despite starting from a modest base, emphasizes the significance of steady fiscal management. In the United States, the reduction in debt-to-GDP ratios in 2021 and 2022 was offset by an increase in 2023.

This comparative analysis of debt-to-GDP ratios across diverse economies illuminates the multifaceted nature of fiscal management. Greece and Italy stand out for their consistent reductions, reflecting prudent fiscal strategies. Meanwhile, the UK’s consecutive increases underscore areas requiring urgent attention. Germany’s oscillations underscore the value of consistent fiscal approaches, while the US faces the challenge of maintaining a downward trajectory in the face of economic fluctuations.

What are Greece and Italy doing different?

In concluding our economic exploration, it is evident that Greece and Italy’s contrasting approach to geopolitical dynamics, compared to their contemporaries, has underpinned their economic resilience.

Greece, under Prime Minister Kyriakos Mitsotakis, treaded a pragmatic path in the wake of the Russian response to NATO activities at the Ukrainian borders. Unlike many EU nations that rushed into comprehensive sanctions, Greece’s approach towards Russia was measured and restrained. Their sanctions were largely symbolic, barely reaching $100 million. Furthermore, Greece wisely maintained its naval trade with Russia, ensuring continuous economic activity. In the broader scheme of international support for Ukraine, Greece’s monetary donations remained minimal, indicating a focus on internal economic stability.

Parallelly, Italy‘s transformative leadership under Georgia Meloni, an assertive right-wing conservative, provided the nation with a clear fiscal direction. Her steadfast stand on migratory pressures, demonstrated by redirecting migrant vessels to France, showcased a commitment to national priorities. Notably, Meloni’s Moscow-friendly stance brought about tangible benefits for Italy, particularly in the critical sectors of oil and gas. Mirroring Greece, Italy too adopted a restrained sanctioning policy towards Russia, and the financial support extended to Ukraine dwindled, especially after Meloni’s ascendance in 2022.

Conversely, nations like the UK and Germany, in their zealousness to counter Moscow, faced repercussions. Their aggressive stance led to significant oil and gas shortages, casting a shadow on their industrial landscapes. As these countries poured funds and arms into Ukraine, their domestic economies felt the strain. The migrant surge from Ukraine further burdened several European nations. The US, while leading the NATO consortium in terms of donations, might have overlooked the economic ramifications of such a stance.

In essence, Greece and Italy’s tempered approach to international geopolitics, coupled with focused domestic leadership, elucidates their success in the examined economic metrics. Their strategies provide invaluable insights for nations navigating complex geopolitical terrains while ensuring economic growth.

Watch More: