In today’s European landscape, the demand for Russian gas has become increasingly evident. Many European nations are prioritizing the assurance of sufficient gas supplies, even at the potential cost of straining their alliances within the European Union (EU). Surprisingly, several countries that were expected to adhere to EU directives by imposing sanctions on Russian oil and gas have not only continued trading with Russia but have also heightened their dependence on Russian energy resources.

Spain’s Gas Gambit: Imports Surge, Dependency Grows

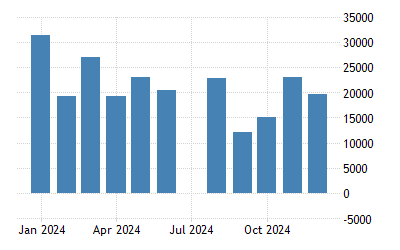

In July, Spain experienced a notable surge in its imports of Russian natural gas, with a remarkable 65% increase compared to the previous year. This surge has catapulted Spain into the position of being the second-largest customer for Russian gas, following only China in terms of its reliance on Russian gas supplies.

Despite the European Union’s imposition of sanctions on Russian crude oil and petroleum products, gas imports were notably excluded from these restrictions. Nevertheless, EU member nations have been strongly encouraged to cease their procurement of Russian gas, with calls for a comprehensive phase-out.

Contrary to these calls, Spain’s reliance on Russian gas has notably risen, accounting for 28% of its total imports in July. This increase in dependence on Russian gas within Spain significantly contributes to Russia’s revenue, with the EU’s total purchases of Russian liquefied natural gas (LNG) estimated at a substantial $5.29 billion for the year 2023.

Experts stress the imperative need for a more expeditious transition to renewable energy sources and a concurrent reduction in reliance on Russian gas. Meanwhile, Russia is diligently securing alternative gas routes, exemplified by the ongoing development of the Siberia-2 gas pipeline to China, in anticipation of potential fluctuations in European demand for its gas.

Read More: One move by Putin turns Spain into the most Russia-dovish country in Europe

Czechia’s Oil Odyssey

Czechia has seen a notable increase in its imports of Russian oil, even in the face of European Union (EU) sanctions against Russia. These imports have reached their highest levels since 2012, reflecting a significant shift in the country’s energy dynamics.

Although EU sanctions targeting Russian oil imports were enforced in December 2022, an exception was made for the Druzhba pipeline, which traverses Ukraine and serves as a conduit to various European destinations. Consequently, the share of Russian oil in Czechia’s overall imports has been steadily on the rise.

Analysts had anticipated this trend, suggesting that EU refiners had strategically stockpiled crude oil as a precautionary measure to counter potential disruptions in the transit of oil through Ukraine.

The increase in Russian oil imports prompted protests in Prague, where the “No to Russian Oil” initiative called upon the government to reduce supplies, citing security and solidarity concerns. However, the Ministry of Industry and Trade argued that an immediate replacement for Russian oil supplies was not feasible.

Czechia relies primarily on two sources for its oil: the Druzhba pipeline from Russia and the IKL pipeline, which connects to the TAL pipeline originating in Italy and passing through Germany. Notably, neighboring Slovakia heavily depends on Russian oil for up to 70% of its energy needs, while Poland and Germany have taken steps to reduce their reliance on Russian oil imports.

Spain: Europe’s Unexpected Russia Enthusiast

Spain has seen a significant shift in its energy imports, with Russian successfully becoming its second-largest gas supplier, surpassing Algeria in volume. This change has made Spain one of the most Russia-friendly countries in Europe. Historically, Algeria had been a vital gas provider for Spain, but strained diplomatic relations emerged due to the Western Sahara dispute. Spain’s support for Morocco’s Western Sahara autonomy plan led to the abandonment of a 2002 friendship pact with Algeria. Russia strategically increased gas exports to Spain while diminishing reliance on Algeria, causing tensions between the two nations. Consequently, Russia now stands as Spain’s second-largest gas supplier, accounting for 24% of the country’s total gas demand.

Read More: Another nation rises up for Russia and leaves its anti-Russia govt. baffled

Czech Republic’s Russian Renaissance

Recent developments in Central Europe reveal an unexpected shift towards pro-Russian sentiments. Austria and Slovakia have gravitated towards pro-Russia governance, while the Czech Republic has witnessed waning anti-Russia sentiment. Russian propaganda and influence have found a foothold in the region, despite legal repercussions for public endorsements of Russian aggression in Ukraine. Consequently, support for Ukraine is diminishing, while backing for Putin and Russia is on the rise. This transformation in the political landscape raises concerns about the possibility of similar shifts occurring in Western Europe as Russian influence continues to expand.

As Central Europe flirts with a newfound Russian romance, the EU watches nervously. Pro-Russian sentiments in Spain, Austria, Slovakia, and the Czech Republic raise eyebrows and questions. While Western Europe observes, it might want to check its own relationship status with Russia. Love is in the air, but is it blind to the geopolitical realities? Only time will tell if this newfound affection will last or if Europe will have to rethink its relationships in this ever-complicated love triangle.

Watch More: