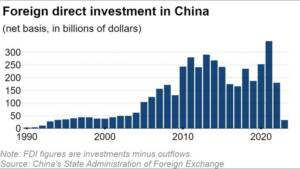

China’s Foreign direct investment (FDI) has reached its lowest point in three decades, as indicated by recent official data. In 2023, China received a net FDI of $33 billion, marking an 80% decrease from the previous year. While the figure remains positive, denoting new investments surpassing outflows, this marks the second consecutive year of decline and is now less than 10% of the peak observed in 2021 at $344 billion.

The decline is attributed to heightened scrutiny on espionage allegations and U.S. sanctions, causing foreign companies to reconsider their investments in China. Notably, FDI for the October-December quarter saw inflows exceeding outflows by $17.5 billion, a recovery from the preceding quarter which experienced the first-ever net outflow. These trends reflect a cautious approach by foreign corporations amidst the evolving geopolitical landscape and regulatory environment in China.

Join us on Telegram: https://t.me/tfiglobal

China’s current foreign direct investment (FDI) situation marks a departure from its historical efforts to attract global investments, talent, and technology. The country initiated the “reform and opening up” policy in the late 1970s, a cornerstone of which was emphasized by Deng Xiaoping during his 1992 tour of southern China.

Recent FDI data reveals a notable downturn, with the lowest levels observed since Deng’s push for policy acceleration in 1992. This decline is attributed to a shift in the Chinese government’s priorities, particularly in the realm of national security. Foreign companies are downsizing their operations in response to increased governmental focus on safeguarding national interests, including a crackdown on espionage. Authorities have tightened control over research firms engaged in market analysis and related activities, leading to reports of detentions of foreign company employees.

Highlighting this trend is the withdrawal of Gallup, an American research company, from China in the preceding year, as reported by the Financial Times. These developments underscore the evolving landscape of foreign involvement in China, with a discernible impact on global businesses and research entities operating within the country.

The impact of regulatory changes on foreign businesses in China is evident, particularly concerning research and investment activities. Revisions to the anti-espionage law, implemented in July, have reportedly led to delays in comprehensive business condition assessments by U.S. and European companies. An executive from an American company noted the challenges in conducting necessary research for new investments.

Japanese businesses echo these concerns, with a survey of companies operating in China revealing apprehensions about their daily operations due to uncertainties surrounding the anti-spying law. Respondents highlighted difficulties in obtaining approval for investment proposals from their headquarters.

Read More: Is the US pushing China out of the Internet?

Furthermore, global dynamics in the semiconductor industry are shifting. The U.S., restricting China’s access to advanced semiconductors, has witnessed a decline in China’s share of chip-related foreign direct investment (FDI) from 48% in 2018 to 1% in 2022, as reported by the Rhodium Group. Conversely, American chip-related FDI surged from 0% to 37%, while the combined share of India, Singapore, and Malaysia rose from 10% to 38%.

These shifts are exemplified by specific company actions, such as Teradyne relocating its chip fabrication testing equipment production from China to Malaysia and Graphcore, a British chip developer for AI applications, reportedly laying off most of its employees in China.

Automakers are adapting to the increasing competitiveness of Chinese players, with Mitsubishi Motors announcing in October the cessation of auto production in China. Likewise, Toyota Motor and Honda Motor are downsizing staff in their Chinese joint ventures to navigate the evolving market dynamics.

A protracted economic slowdown in China contributes to the hesitancy of foreign investments. The sluggish growth, linked to a weakened domestic demand exacerbated by a real estate market downturn, raises concerns about deflationary pressures.

Read More: Unseen Shadows: US Quietly Gears Up for Potential Conflict with China over Taiwan:

While Chinese companies demonstrate technological advancements in sectors like electric vehicles and surveillance cameras, they still rely on foreign companies, particularly for advanced chips. The departure or downsizing of foreign corporations in China may impede the nation’s productivity enhancements. Such trends, coupled with a shrinking labor force, pose potential risks to China’s medium to long-term economic growth. The interconnectedness between domestic and foreign enterprises underscores the delicate balance that shapes China’s economic landscape.

Recognizing potential challenges, the Chinese government recently adjusted the revenue threshold for companies undergoing screenings before approval of joint ventures under antitrust laws. This move, aimed at facilitating acquisitions, including those involving foreign entities, is intended to enhance the appeal of the Chinese market.

Despite these adjustments, foreign companies express apprehension due to uncertainties surrounding the implementation of China’s policies, particularly those pertaining to national security and other domains. Additionally, concerns persist regarding structural factors contributing to the prolonged economic slowdown.

The effectiveness of the government’s endeavors to foster openness and attract new foreign investments remains uncertain. As China strives to navigate the complex interplay of economic policies, national security considerations, and global market dynamics, the outcomes of these efforts will be closely monitored by foreign businesses seeking assurance and clarity in the evolving Chinese business landscape.