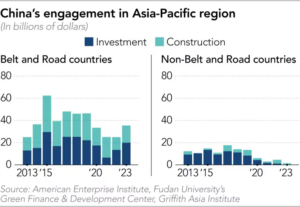

In 2023, Chinese investment in the Asia-Pacific region experienced a significant surge, as highlighted in a recent report by Griffith University in Brisbane and Fudan University in Shanghai. Despite a slowdown in the global economy and challenges faced by China, the world’s second-largest economy, the report indicates a noteworthy increase of 37%, reaching nearly $20 billion in Chinese investments across the Asia-Pacific.

Furthermore, the study reveals a parallel uptick in construction contracts, amounting to approximately $17 billion, with a notable 14% rise from the previous year, partly funded by Chinese loans. This contrasts sharply with the broader trend, as the report points out a 12% decline in overall foreign direct investment in the emerging economies of Asia during the same period.

Join us on Telegram: https://t.me/tfiglobal

The data becomes particularly relevant as it coincides with the announcement from the Chinese government, setting a growth target of “around 5%” for the gross domestic product in 2024, mirroring the previous year’s objective. However, analysts express concerns about the challenges faced by the Chinese economy, including sluggish global and domestic demand, constrained manufacturing, and an enduring downturn in the property market.

In 2023, a substantial portion of Chinese overseas activity concentrated on nations aligned with the Belt and Road Initiative (BRI), an ambitious initiative by Beijing aimed at establishing an extensive infrastructure network spanning from Asia to Europe and beyond. Christoph Nedopil, the director of the Griffith Asia Institute, provided data indicating a remarkable shift in investment dynamics. Investment in countries outside the BRI framework plummeted to an unprecedented low of $120 million, marking a 90% decline from the already record-low figures observed in 2022.

Notably, BRI participant countries dominated the landscape, securing 92% of the construction contracts.

“The most interesting trend we found in 2023 was the strong emergence of green China engagement through energy and mining investment, as well as China’s engagement in the region against the trend, which is going up not down,” Nedopil commented.

Read More: Taiwan in Crisis: Chinese Coast Guard’s Move Sparks Panic

The comprehensive data on Chinese engagement, encompassing both investment and construction contracts, indicates a discernible return to patterns observed before the onset of the COVID-19 pandemic. Historically, Chinese engagement in the region prominently featured investment, with construction assuming a predominant role for the first time in 2021, constituting over 70%. In 2022, the report notes a shift, with investment comprising approximately 54% of the total engagement, nearing pre-pandemic levels.

In the regional landscape, Southeast Asia emerged as a focal point, attracting around 50% of China’s investment in 2023, marking a substantial 27% increase from the previous year. Notably, Indonesia secured the highest share, receiving approximately $7.3 billion. A noteworthy transaction involved TikTok’s acquisition of 75% of Tokopedia, the e-commerce unit of Indonesian tech conglomerate GoTo, amounting to $840 million. This move was in response to regulatory requirements mandating the separation of TikTok’s shopping features from its social media functions in October.

Conversely, six countries, namely the Philippines, Mongolia, Myanmar, Papua New Guinea, Tajikistan, and Turkey, experienced a complete cessation of Chinese engagement, witnessing a 100% drop from 2022. Christoph Nedopil, director of the Griffith Asia Institute, attributed these instances to a confluence of political and economic risks. Notably, the Philippines experienced a cooling in bilateral relations with China. Additionally, engagement in the China-Pakistan Economic Corridor (CPEC) decreased by approximately 74%, influenced by political unrest in Pakistan and concerns over militancy. Similarly, Chinese engagement in Australia witnessed a decline of about 66%.

In the Asia-Pacific region, Chinese private enterprises dominated investment activities over the past year, witnessing an increase in the number of Chinese participants compared to the preceding two years. In contrast, state-owned enterprises continued to dominate construction engagement, maintaining a pattern observed in the previous year.

The surge in private investments primarily focused on the energy transition and battery materials sectors, highlighting China’s significant role in the global supply chains for critical minerals and renewable energy. Zhejiang Huayou Cobalt, a leading cobalt refiner, played a substantial role, contributing 21.2% to the total investment, followed by Alibaba’s e-commerce group with an 11.6% share.

Chinese initiatives in metals and mining, particularly those relevant to the green transition, such as lithium and battery materials like nickel for electric vehicles, were concentrated in Indonesia, South Korea, Vietnam, and Bangladesh. This engagement reached $5.3 billion, reflecting a notable 130% increase from 2022, although still below the levels seen in 2018 and 2019.

Read More: Taiwan Minister Reports 5 Chinese Coast Guard Ships in Kinmen

Significant investments in the electric vehicle sector included partnerships like the joint venture between Zhejiang Huayou Cobalt and LG Chem in South Korea, along with Chinese automakers establishing plants in countries like Thailand, Vietnam, and Malaysia.

Contrary to Beijing’s proclaimed strategy of pursuing “small yet beautiful” projects, Chinese engagement in the Asia-Pacific, including the Belt and Road Initiative, maintained a focus on substantial endeavors. Despite a decade of the Belt and Road, discussions about recalibration persist, particularly in light of China’s economic challenges.

While the average deal size for investments remained high in 2023 at $499 million, more than double the low in 2021, it slightly decreased from the $583 million recorded in 2022. Similarly, for construction projects, the deal size increased to $401 million in 2023 from $285 million the previous year.

The report anticipates a continued rebound in Chinese investment and construction activities within the region in the current year. This resurgence is attributed to a heightened emphasis on the green transition and a parallel softening of domestic demand, compelling Chinese enterprises to explore opportunities abroad.

“Furthermore, China might continue engagement in large strategic infrastructure projects that might not have direct financial benefits,” the report says, pointing to rail, road and ports, as Beijing seeks to “avoid dependence on vulnerable transportation links.”