The recent escalation between Israel and Iran has sent ripples through global energy markets, and nowhere is the impact more pronounced than in Beijing’s strategic calculus. With the Middle East once again proving volatile, China is actively reassessing its energy security and the long-stalled Power of Siberia 2 gas pipeline from Russia is suddenly back in focus.

Middle East Turmoil and China’s Energy Anxiety

For years, China has sourced a significant portion of its natural gas—about 30%—in the form of liquefied natural gas (LNG) from Qatar and the United Arab Emirates, shipments that must pass through the Strait of Hormuz.

This narrow maritime chokepoint became a flashpoint during the Israel-Iran conflict, as Iran threatened to close it in response to military escalations. Even though a ceasefire has since been announced, the episode exposed just how vulnerable China’s energy lifelines are to geopolitical shocks in the Middle East.

The conflict also pushed oil and gas prices higher, and although the markets stabilized once de-escalation began, the episode underscored the risks of relying on a region where rivalries can quickly threaten global supply.

Reviving the Power of Siberia 2 Pipeline

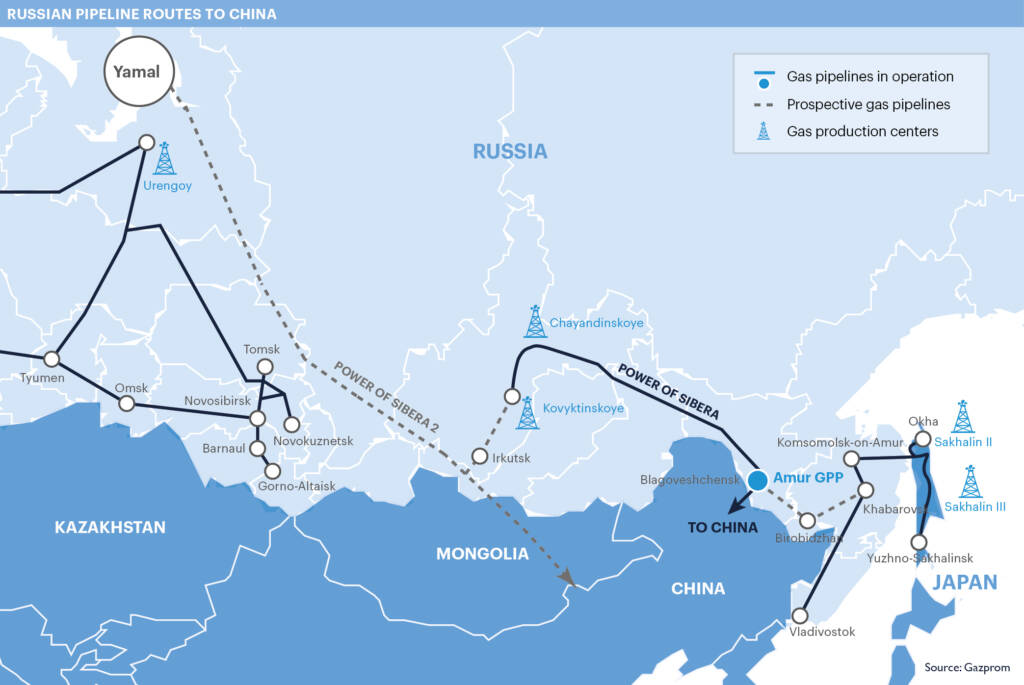

Talks over the Power of Siberia 2 pipeline, a massive project intended to deliver Russian gas to China had previously stalled over disagreements about pricing, ownership, and Beijing’s reluctance to deepen its dependence on Russian energy.

But the threat of supply disruption from the Middle East has forced a rethink in Beijing. Chinese officials now see clear geopolitical advantages in securing a stable, land-based pipeline that bypasses maritime chokepoints.

The recent instability and uncertainty in the region have highlighted to Chinese leaders the strategic advantages of securing reliable, overland pipeline routes for energy supplies.

Russian officials, too, recognize the opportunity. With President Putin set to visit China for high-level economic talks, both sides appear motivated to break the deadlock and finalize the pipeline deal, which could guarantee China an uninterrupted flow of energy from the north.

Also Read: With its new energy pipeline, Russia is eating up China’s pie in Pakistan

Strategic and Economic Implications

For China, the pipeline is more than just an energy project, it’s a hedge against future instability in the Middle East. The move would reduce China’s exposure to maritime disruptions and give Beijing greater leverage in global energy markets. For Russia, the deal promises a reliable buyer for its vast natural gas reserves at a time when European markets remain uncertain.

The renewed interest in the pipeline also comes as the U.S. seeks to “drive a wedge” between Moscow and Beijing, further incentivizing both countries to deepen their partnership. Meanwhile, China’s independent refineries, or “teapots,” have become increasingly reliant on cheap Iranian crude, a relationship that could become more complicated if Middle East tensions flare up again.

The Israel-Iran conflict has exposed the fragility of global energy supply chains and accelerated a strategic realignment in Eurasia. For China, the lesson is clear: diversifying energy sources and routes is not just prudent—it’s essential. As a result, the Power of Siberia 2 pipeline, once bogged down by negotiations, is now seen as a critical piece of China’s energy security puzzle, with both Beijing and Moscow eager to seize the moment.