A few months ago, China launched the “dual circulation” plan with much fanfare in the country. Under the “dual circulation” strategy, Chinese policymakers wanted to change the nature of the Chinese economy from an export-driven to domestic demand-driven, and therefore, it was also termed as “Atmanirbhar China” plan by the analysts at TFI.

However, looking at the latest data on the consumer deflation, one can argue that the Atmanirbhar China plan is dead even before arrival. As per the data of China’s National Bureau of Statistics, consumer inflation reached negative territory for the first time in the last 11 years. In November 2020, Consumer Price Index (CPI) declined by 0.5 per cent and this was the first decline since October 2009 when the countries around the world were under recession due to the financial crisis.

Food prices declined by 2 per cent due to a 12 per cent decline in pork output – a major diet in the country. A decline in prices means the consumers in China are not spending money to purchase goods while the Chinese policymakers want the domestic demand to shoot upwards. The behaviour of Chinese consumers is completely opposite to the policies of the Chinese government, and therefore, the “dual circulation” plan is set to fail.

China’s economy is heavily export-driven but at a time when the countries around the world are turning protectionist, and the share of export in GDP is declining, the Chinese model is not sustainable. Therefore, the government is trying to boost domestic consumption, but, as the data shows, the Chinese consumer is averse to consumption.

Domestic consumption constitutes around 72 per cent of the Indian economy while for the Chinese economy; it is only a mere 55 per cent. Therefore, the Indian economy is largely immune to global headwinds while the Chinese economy is dependent on global trade and markets.

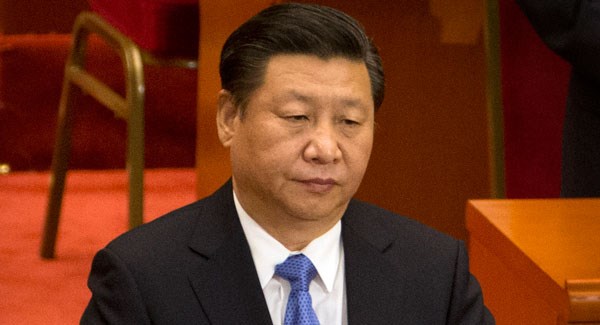

While Xi Jinping continues to claim that China isn’t going inwards with “dual circulation”, it is becoming clearer that Beijing no longer has the teeth to push internationalisation of its corporate giants like Huawei, Tencent etc. And even infrastructure companies are no exception to the same because the BRI is facing setbacks no less severe than China’s export industry.

Chinese President Xi Jinping’s Belt and Road Initiative (BRI) had given rise to some of the biggest infrastructure giants like the China Communications Construction Company (CCCC). Today, these companies have subsidiaries, branches, research institutions and service hubs across all parts of the world including Europe, the Americas, Africa, South and Southeast Asia and the Middle East.

However, now these companies are collapsing one after another. Therefore, the Chinese government wanted the domestic consumer to compensate for the loss of the global market for companies like Huawei, but the Chinese consumers are showing their back to the government plan. Also, given the fact there is very little social security in China, the consumers lean more towards saving amid the pandemic, instead of spending.

“Because of the uncertainty of COVID and also people’s uncertainty on their disposable income, there’s a tendency of going for more value for money,” Derek Deng, partner at Bain said.

At a time when inflation in India is more than the higher limit (6 per cent) despite several supply-side measures, in China, the demand has fallen so low that there is deflation in the country instead. “The government stimulated production before consumption to deal with the pandemic, leading to excess supply vs demand,” said Dariusz Kowalczyk Chief Chinese Economist at Credit Agricole CIB.

Therefore, the “dual circulation” policy or the ‘Atmanirbhar China’ plan is a complete failure, and given the fact that the export is also supposed to collapse given the re-routing of the supply chain, the Chinese economy is headed for hard days ahead.