Finally, Europe is embracing the era of de-dollarization. What’s even more surprising is that a Western European country is taking the lead, instead of Hungary or Poland.

The US dollar’s dominant position in international trade and finance has been widely accepted for a long time. However, recent events such as the war in Ukraine and the collapse of SVB have caused people to question the dollar’s superiority. As tensions rise and geopolitical uncertainties deepen, countries all over the world are reassessing their reliance on the US dollar and exploring alternative options.

The conflict in Ukraine has exposed the vulnerability of the world’s financial system to geopolitical unrest. Countries are becoming more aware of the potential risks of being subject to the whims of US foreign policy, as evidenced by the US imposing economic sanctions on Russia and other parties involved in the conflict. As a result, some nations are seeking ways to reduce their dependence on the US dollar in their international trade.

For example, China has been actively promoting the use of its own currency, the yuan, in international trade and investment. China is establishing a different financial ecosystem that operates outside the conventional US dollar-dominated system through initiatives such as the Belt and Road Initiative and the establishment of the Asian Infrastructure Investment Bank.

To avoid using the US dollar, many countries are exploring the use of digital currencies and blockchain technology. Sudan and Zimbabwe, both African nations, have been at the forefront of this movement.

Meanwhile, Russia is developing its own digital currency, the digital ruble. The move away from the US dollar is not limited to emerging economies. In a surprising turn of events, a European nation has decided to join the de-dollarization campaign. Paris is now joining Beijing in the de-dollarization efforts.

France braces Yuan!

According to a media report from Global Research, France has taken a step towards De-dollarization in Europe by trading in Yuan. Reportedly, Chinese and French energy companies have signed the first-ever LNG contract to be paid for in renminbi yuan. The deal, involving 65,000 tonnes of LNG from the United Arab Emirates, represents a significant development in Beijing’s efforts to challenge the US dollar’s status as the world’s “petrodollar” for the trade of gas and oil.

China’s push to establish the yuan as a prominent currency in global energy trading has gained momentum, as China National Offshore Oil Company (CNOOC) closed a deal with TotalEnergies. Yu Jin, the general manager of CNOOC, emphasized that using the yuan for global resource procurement could “promote the globalization of energy trading and build a more diversified ecology.”

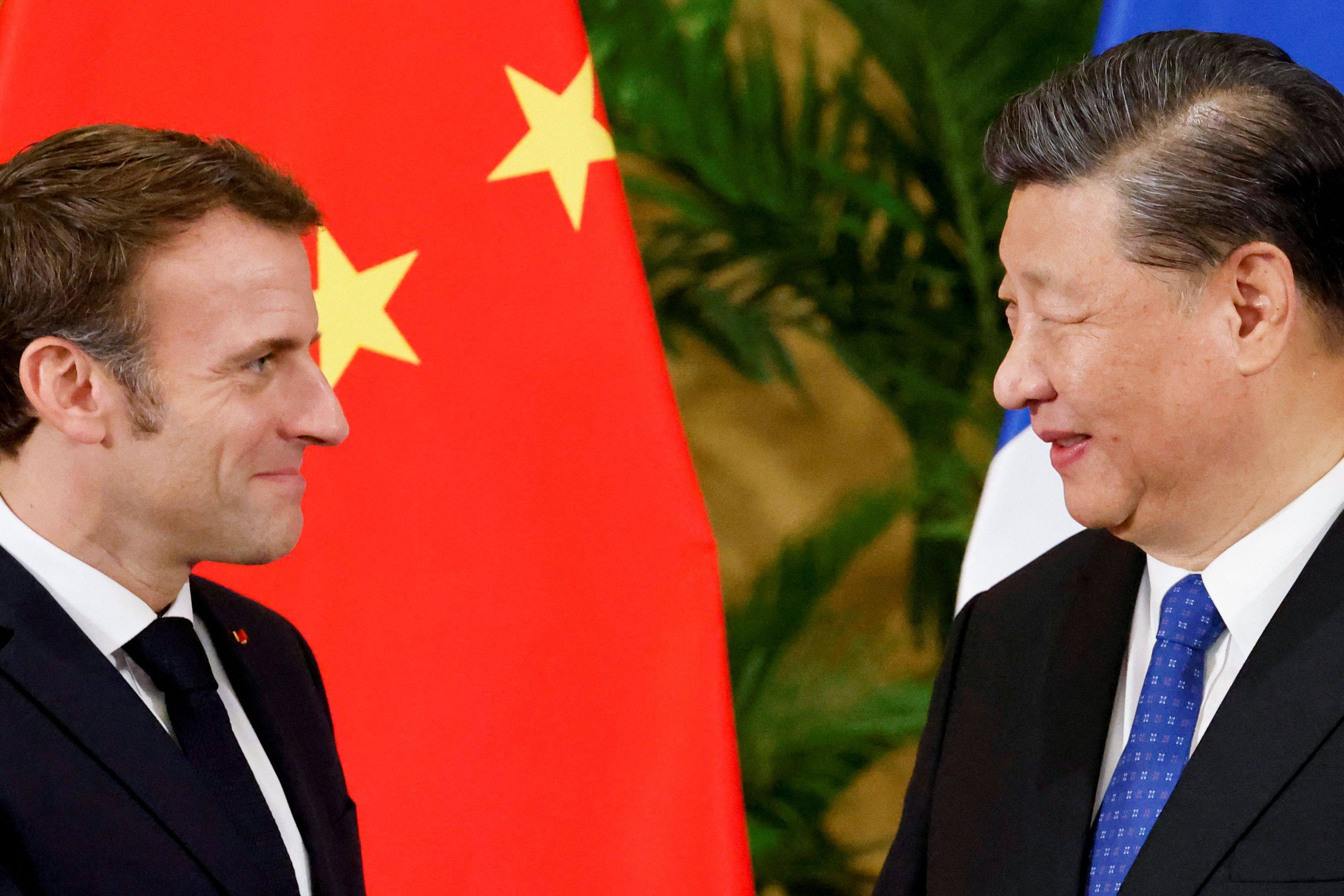

China has been actively promoting the yuan for trade settlement, aiming to become a major player in the global liquefied natural gas (LNG) market. Previously, France had been cautious about promoting yuan trade against the dominant US dollar, but it is now actively supporting it. This development comes at a significant time, as French President Emmanuel Macron is scheduled to visit Chinese President Xi Jinping.

Read More: OPEC+ delivers a final blow to the West

As per French media reports, President Emmanuel Macron and European Commission President Ursula von der Leyen will be embarking on a three-day state visit to China, where they will meet with Chinese President Xi Jinping. Accompanied by a delegation of more than 50 French CEOs, Macron will meet with the French business community, but the focus will be on how he and von der Leyen will discuss bilateral cooperation with China.

This development signifies France’s interest in embracing the yuan as an alternative currency for international trade and investment, which could potentially reduce reliance on the US dollar. China’s efforts to internationalize the yuan are gaining momentum, and this could reshape the global finance and trade landscape in the years to come.

This turn of events is surprising, as just a few months ago, France was actively opposing China’s actions in Xinjiang and its control in the Indo-Pacific region. France had openly criticized China for its persecution of Uyghurs and called for an end to its exclusivity in the Indo-Pacific. However, this change in stance was inevitable, as France has historically been against the supremacy of the dollar.

The Decades’ old conflict!

Since the signing of the Bretton Woods system, the US dollar has been recognized as the foundation of the global monetary system, with other currencies linked to the dollar. At that time, France and other countries supported the agreement, as it helped to facilitate international trade and stabilize exchange rates.

However, in the 1960s and 1970s, France became increasingly concerned about the dominance of the US dollar and its impact on their economy. In particular, France criticized the US’ ability to print dollars to finance its deficits, which led to inflation and depreciation of the dollar. This eventually led to the collapse of the Bretton Woods system in 1971, when the US abandoned the gold standard and the fixed exchange rate system.

Moreover, France has expressed concerns about the potential abuse of the SWIFT system by the United States to impose sanctions on other countries. Consequently, France has called for the creation of an independent European payment system that would be less reliant on the US dollar-dominated SWIFT system, thereby reducing vulnerability to extraterritorial sanctions imposed by the US. Furthermore, France has been vocal in its support for changes to the global monetary system that would reduce the dominance of the US dollar.

Read More: Zimbabwe fast-tracks de-dollarization of its mineral sector

The Biden-Macron Angle

Also, it is no secret that French President Emmanuel Macron has been a subtle critic of US President Joe Biden. The rivalry between them has become increasingly apparent, especially after the Ukraine war.

On numerous occasions, the United States has clashed with France, whether it’s over the war in Ukraine, relations with Russia, or competing for arms deals. The two nations have frequently found themselves at odds.

Read More: Macron ridicules Biden like a Pro at the COP 27 summit

Concerns about the stability of the global economy have increased as a result of the recent banking collapse in the USA, which has accelerated the momentum of the De-dollarization campaign. President Emmanuel Macron of France has become a well-known figure in this campaign by forming a strategic alliance with China to counter the dominance of the US dollar. However, it is still unclear how this transactional relationship between France and China will play out.

With Macron leading the charge, Europe is taking a strong stand against the hegemony of the US dollar and communicating this to Washington. The formerly obedient vassal continent is now emerging as a formidable foe in the fight against the US dollar’s dominance. As the De-dollarization campaign gains traction, the US must now reckon with the growing challenge posed by France and its allies as they seek to reshape the international monetary landscape.

The outcome of this unfolding saga will undoubtedly have far-reaching implications for the global economy and the future of the US dollar’s supremacy in the international financial system. As the campaign against the USA gains momentum in its vassal continent, the world eagerly awaits how this strategic partnership between France and China will shape the future of the global economic order.

Even traditional US allies, such as the European Union, have been exploring ways to conduct transactions without the need for the US dollar. The EU has been working on establishing its own payment system, known as the European Payments Initiative, to facilitate euro-denominated transactions and reduce reliance on the US dollar.

Therefore, the US dollar is still the king of the financial jungle, but the throne may be getting a bit wobbly as the De-dollarization campaign gains ground. It’s not easy dethroning a currency that has been dominating the reserve game for so long, but hey, Rome wasn’t built in a day either.