The US is slowly but steadily moving towards bankruptcy. The United States has never experienced a debt default in modern history. The debt ceiling, which the US government set for itself, has been raised or suspended over time to prevent the United States from going into default on its obligations.

However, as a result of this debt ceiling and the inflated debt bubble that the US has created around itself, the US is currently being forced to file for bankruptcy.

Whenever the US needs money, it gets a loan from the Federal Reserve, and if the Federal Reserve wants money, then it simply prints more. The US government gives the Fed Reserve an IOU, or government bond, which isn’t even worth the paper on which it is printed but works on the basis of trust. An IOU, a phonetic acronym of the words “I owe you,” is a document that acknowledges the existence of a debt.

These worthless IOUs are sold to foreign central banks. Other countries buy these worthless IOUs as risk-free investments because they feel that they are essentially lending money to the United States.

But, as economic experts say, your debt is only sustainable when you generate more profits than the cost of the debt that you are taking on. It means that if you take on a debt of $100 and you are paying an interest rate of $10 on that, you must be at least generating a wealth of $111 to make your debt sustainable.

However, do you think the US is investing the wealth properly to generate enough funds?

Read More: US economy is all set to suffer ten big setbacks in the next six months

To know this, we must understand where the US government is actually spending.

The US has spent a total of billions of dollars sending free aid to Ukraine and many millions more spreading its woke agenda. These activities clearly don’t generate the wealth you need to pay off your debt.

So, the US is effectively running a giant Ponzi scheme and is using other countries to pay for its wars and schemes. A Ponzi scheme crashes when one person in the chain stops being a part of the tomfoolery. The ones at the end of the chain suffer, while the ones in the top layers make a lot of money.

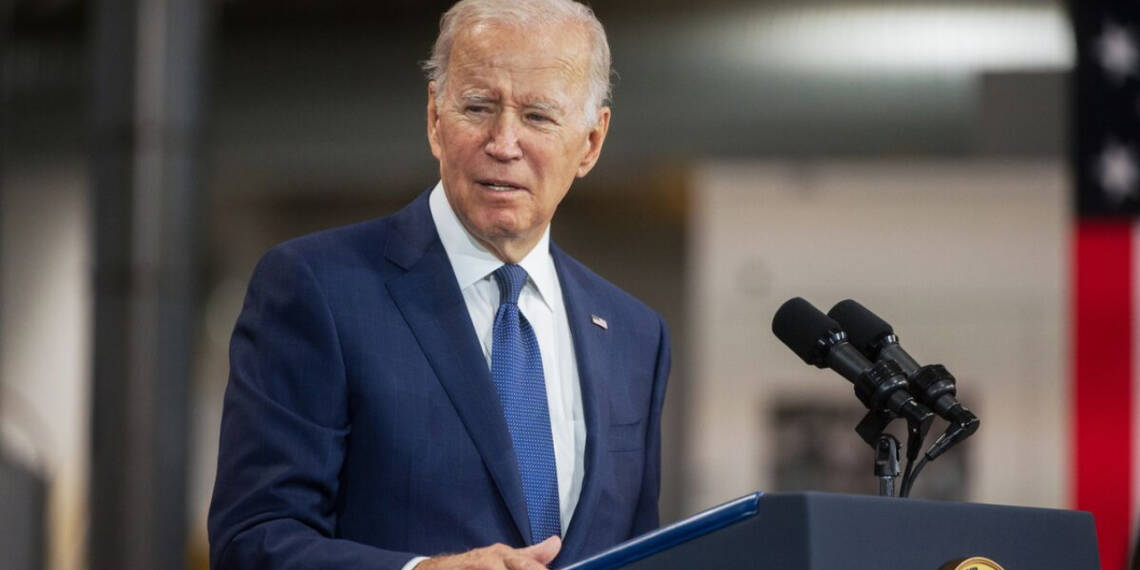

Coming to the present, US President Joe Biden brought the four senior congressional leaders to the White House the following week after the Treasury Department warned that the government might not have enough money to pay its obligations by June.

Read More: The US economy is on ventilator support now

US Treasury Secretary Janet Yellen warned Congress in a letter that the agency could not be able to meet all of the US government’s payment obligations “potentially as early as June 1” if no action is taken by Congress.

The projection gave political calculations in Washington—where Democrats and Republicans were preparing for a protracted standoff—as it raised the potential that the United States is on the edge of a historic default that would shake the global economy.

Now, the point is that the US dollar cannot remain the global currency forever. Countries should start trading in their own currencies, and we must tell you that the process has already begun.

Countries all across the globe are de-dollarizing their economies and using currencies like rupees and rubles. Countries like France, Egypt, Zimbabwe, and Argentina have taken steps towards de-dollarizing their economies, and some others are on the way to doing so.

It looks clear that the US dollar has lost the credibility it once had. Now, it cannot print dollars or issue bonds recklessly. The US is clearly approaching an end to its economic dominance, and this time, its rescue mission to save itself from bankruptcy will not succeed.

https://www.youtube.com/watch?v=H1mubdllWDU