Earlier, the government regulations would stop the power generator companies from ratcheting up the prices, discouraging companies from generating power while incurring losses.

Given the dire health of the Chinese economy, any state-backed subsidy scheme is highly unlikely.

As the electricity generators look poised to increase output riding on higher electricity prices now, other coal-powered industries, predominantly metal industries, will find it strenuous to secure their power supplies.

Chinese Electricity Reform : The “Liberty” word has no place in the Chinese Communist Party’s dictionary; however, the alien concept is now surfacing in the Chinese power market.

China liberalizes its power sector

The National Development and Reform Commission, China’s top economic planning body, on Tuesday said it will liberalize the state-controlled power sector to alleviate the surging Chinese electricity crisis.

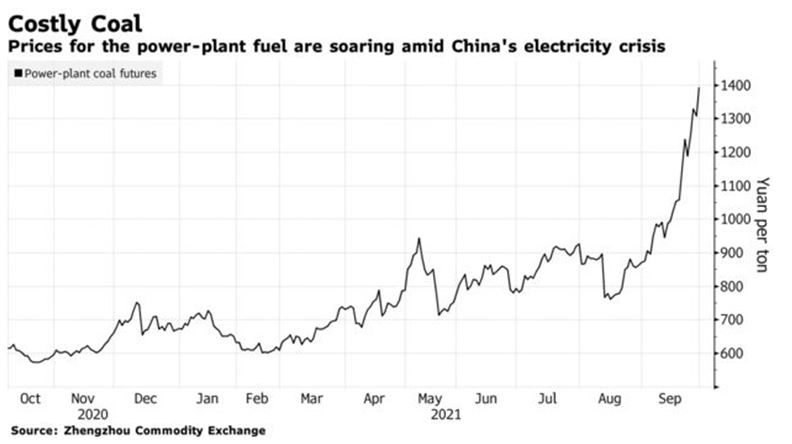

Since the coal supplies are running tight and power grids are strained, electricity generation has become a non-profitable business for the coal-fired power generators. Earlier, the government regulations would stop the power generator companies from ratcheting up the prices, discouraging companies from generating power while incurring losses.

Inflation to go up as electricity generation becomes costlier

Now, as the power market gets liberalized, electricity prices will go further up which will help the power generators cover up for the surging coal prices and maintain electricity supplies. The electricity “reform” of may help the Chinese government stabilize the power market in the long run; however, for now it will boost up the already-soaring inflation in the Chinese retail market.

Read More: China is shutting down Aluminium, Textile and many more industries

Chinese government reins in subsidies to the businesses when they needed it the most

Fearing the increased power prices could weigh on the industrial output, the NDRC also urged the provincial governments to provide subsidies to small and medium-sized enterprises. But given the dire health of the Chinese economy, any state-backed subsidy scheme is highly unlikely. This means that the small and medium-sized enterprises, which are most prone to the ongoing power crisis amid the surging pandemic, are left to fend for themselves by the state machinery.

As far as the Chinese retail market is concerned, the electricity “reform” at this time will only shore up the already-inflated prices. With the output becoming more costly, the Chinese businesses will lose their competitive advantage in the foreign markets. The Evergrande crisis, alongside the energy crisis, has already intensified instability in the Chinese economy, and now the ill-thought electricity “reform” will only exacerbate the woes of the Chinese businesses.

China’s gruesome power crisis

China is reeling under an intense coal crisis for over a week now, triggering an energy shortage across the country. The crisis is so dire that even metropolises like Shanghai and Beijing are staring at an unforgiving power crisis in the eye. The rolling blackouts have already started showing effects in at least four districts of the capital city of Beijing.

Also, industrial demand for coal remains high, and China’s extensive network of steel mills and other coal-based industries faces a very real threat of existence in lack of coal supply. However, if China is unable to supply coal for the generation of power, one can only imagine how industries must be reeling under an intense coal crunch, which is why the country’s Aluminium industry has come on the verge of a collapse.

Read More: Just as China prepared to extract coal from its own mines, heavy rainfalls sealed them shut

And as the electricity generators look poised to increase output riding on higher electricity prices now, other coal-powered industries, predominantly metal industries, will find it strenuous to secure their coal supplies.