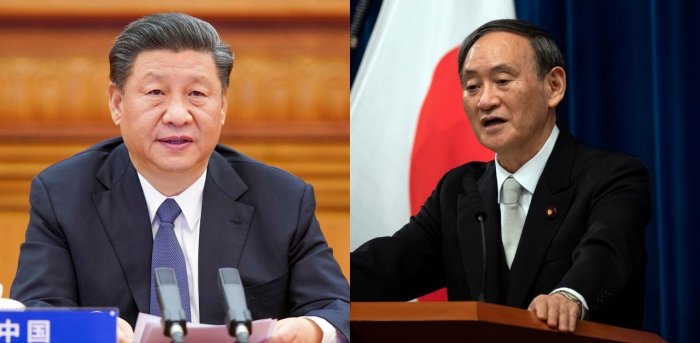

At the annual Asia-Pacific Economic Cooperation Summit, hosted digitally by Malaysia this year, Xi Jinping declared that China will “favourably consider” joining the CPTPP. But Japan has clearly stated that there will be no exceptions for any state and that Japan will uphold the highest standards for states looking to join the exclusive club that nations are clamouring to get in.

China believed that it could dominate the Asian Trade Sector with RCEP, but as India withheld its participation and bi-lateral ties with signatories Australia and Japan, soured Chinese ambitions look set to falter.

To counter the effects of another trade and diplomatic failures of the BRI and the RCEP, China has presented itself to be a willing nation among others to join the TPP, even though it had previously criticized its formation. But with Japan acting as the gatekeeper, China’s entry into the exclusive group looks far from any possibility.

Formally known as the Comprehensive and Progressive Trans-Pacific Cooperation Partnership Agreement, the TPP-11 has recently attracted the interests of a broad number of countries such as the U.K, Thailand, and even China.

Last week, in response to questions about China’s entry into the TPP, Japanese Prime Minister Yoshihide Suga said, “There are 11 members to the TPP, and new countries cannot just join without their approval,” “There’s a big hurdle” for new membership, he added. “We’ll think about it strategically as we respond.”

The Japanese Foreign Minister stressed the principles and standards of the member countries and the importance of the standards of regulations on e-commerce, intellectual property, and state-owned enterprises. He said, “We need to ensure that any new member is prepared to meet these standards”.

Therefore, Beijing’s interests, in particular, have raised flags, given its increasing control over Asia-Pacific trade, as well as its position on state-owned enterprises and intellectual property.

Strict adherence to the current requirements of TPP-11 would test China’s dedication to joining the agreement. For example, to ensure equal competition, the bloc forbids preferential treatment for state-owned companies — partially a response to the global surplus of steel and other goods caused by aggressive capital spending by Chinese state-owned producers. It would also be a tough pill for China to take to prohibit compulsory source-code disclosures.

Japan hopes to expand the TPP-11 into an even larger trade bloc to prevent China from becoming the dominant rule setter on trade but even as chair it does not plan to lower the TPP-11’s standards for the sake of expansion.

While UK’s interest to join the TPP was welcomed, Xi Jinping’s comment to favourably consider joining the TPP received an underwhelmed and unenthusiastic mixed response.

Yorizumi Watanabe, a professor at Japan’s Kansai University of International Studies said: “Japan must make it clear that it will not ease the TPP-11’s existing standards for China,”. He added, “Japan should approach the situation ready to turn China down if it cannot meet the standards.”

Meanwhile, Japan expects the US under President-elect Joe Biden to re-join the TPP-11 and is hesitant to admit China to the bloc before this takes place.

China needs TPP to revive its stagnating economy. The BRI has gloriously failed to materialize and so has the RCEP whose members Australia and Japan are present to contain China rather than offering their help in the expansion of its ambitions in the Asian Trade market.

China’s debt has risen exponentially so much so that its companies have started defaulting on payments at breakneck speed. One of the prominent default cases is that of Huachen Automotive Group. Earlier this year, Huachen defaulted on payment of principal and interest of a 1 billion yuan bond, which is, $151.88 million bonds.

Another leading Chinese state-owned enterprise, Tsinghua Unigroup defaulted and failed to repay the principal on a $450 million bond. The company owes an additional debt of $2 billion and the investors are, of course, worried by the default in connection with $450 million bonds.

China’s local government debt is expected to hit $4 trillion. Serving and former Chinese Finance Ministry officials are alarmed about the awkward situation. There is a real risk of the Chinese government itself committing a default upon its lenders. The Chinese government can neither finance its companies properly nor assure its lenders about its capacity to meet debt obligations.

Therefore, with situations in such dire conditions, China is looking towards the TPP to bail it out. While China’s coronavirus has plunged its popularity, its wolf warrior diplomacy with Japan, Australia, and many other states have made it hard for China to side-line the expansionist and aggressive diplomatic and trade policies. The debt trap policy of China is another reason why countries are now wary of Chinese investments.

Moreover, belligerent activities of China in its periphery regions such as the South China Sea, Indian Ocean, and the LAC have made things more worrisome. The international community believes that China is a more hostile power and a threat to world peace and security than a responsible power should be.