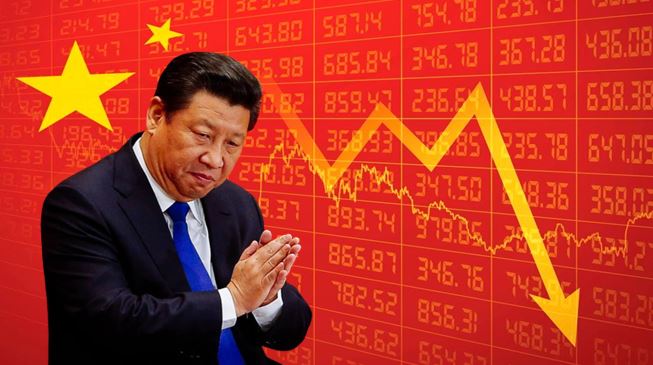

The way in which Chinese Leader Xi Jinping has been conducting the witchhunt of Chinese wealth creators and big domestic firms, it was obvious that China is headed for an economic disaster. But there was still one question and that was, how long will it take for the process to conclude. In view of the latest numbers and developments regarding the Chinese economy, the answer may soon be with us. An index of Chinese businesses listed in Hong Kong, which has been the worst-performing major stock gauge in the world this year, is sliding further behind its peers.

As per reports, Tencent Holdings Ltd. and Alibaba Group Holding Ltd. are among the most heavily weighted stocks in the Hang Seng China Enterprises Index, which fell further 2.4 per cent to a five-year low on Monday. Over the previous month, three months, six months, year-to-date, and over a year, the gauge lagged below all peers. This problem is maturing in such a time period when China is facing the heat of its own wrong decisions. And what is happening today in Hong Kong is a precursor to the future that China will find itself in.

The uncertainty regarding the supply of coal and a possibility of a really cold winter, industries coming to a halt because of the energy crisis, and now on top of that, the falling stock market indices and drying investment, all in all, present the perfect storm for Xi Jinping.

The Hong Kong development

On Tuesday, investor expectations of increased interest rates fueled a global selloff in technology equities, with a Hong Kong benchmark tracking Chinese technology firms closing near a record low. The Hang Seng Technology Index, which began trading in July of last year, dipped 0.3 per cent after recovering from earlier losses of up to 2.5 per cent. The index, which includes Tencent Holdings Ltd. and Alibaba Group Holding Ltd., is set to fall for the fourth week in a row.

Also read: Hong Kong has been crushed by China, but a glint of hope remains

As reported by Bloomberg, Increased regulatory supervision and a sharp surge in yields spurred investor suspicions of a bubble, and megacap technology firms that gained through the pandemic have fallen. Chinese enterprises have been hammered particularly hard, as they are already caught up in Beijing’s regulatory crusade. The so-called Faamg group lost $238 billion in market value overnight, and Amazon.com Inc. has lost money for the year. Hong Kong’s IT index is already down roughly 46% from its February high, with members losing $1.4 trillion in market value.

Bloomberg Intelligence analyst Matthew Kanterman said, “It’s a perfect storm of challenges right now.” “In the short term, a mix of issues such as continuing regulatory obstacles, rising interest rates, and China property contagion fears will almost certainly continue to weigh on China’s tech sector.”

China: In the midst of an economic disaster

The Evergrande collapse is expected to hit the Chinese foreign policy, in a major way. The Chinese foreign policy is presently dictated by the Belt and Road Initiative (BRI) which involves large-scale debt financing by Chinese financial institutions, Chinese State-owned Enterprises (SOEs) and local government financing vehicles.

Read more: Evergrande has collapsed, the next is BRI

As per the Washington-based Institute of International Finance (IIF), China’s debt stood at 300 per cent of its GDP in 2019. However, the overall debt burden is hard to estimate, given the country’s tendency to use local government financing vehicles for bypassing direct debt.

A bigger problem for China is that its SOEs and the LGFVs are the ones financing the BRI projects across the world. Now, as the country moves into a major debt crisis triggered by Evergrande’s collapse, these Chinese institutions are simply losing their ability to finance overseas infrastructure projects.

Meanwhile, China’s banking sector is also at a huge risk. It holds over 80 per cent of local government debts and a large portion of the Evergrande-related debt. China’s commercial banks will not be inclined to dole out more loans to the local government financing vehicles given the level of volatility in the Chinese economy.

The scripting of the downfall of the Chinese economy

Tencent Holdings Ltd. and Alibaba Group Holding Ltd. are among the most heavily weighted stocks in the Hang Seng China Enterprises Index, which fell further 2.4 per cent to a five-year low on Monday. Over the previous month, three months, six months, year-to-date, and over a year, the gauge lagged below all peers.

The magnitude of the losses demonstrates how far Beijing has gone to strengthen its hold on some of the country’s most powerful private firms. The Hang Seng Tech Index in Hong Kong, which has a lot of overlap with the HSCEI, has lost $1.4 trillion in market value since its February peak. On Monday, the index was trading around fresh lows. In August, even the Hang Seng Index entered a bear market.

Almost every sector of China’s stock market has felt the repercussions of the months-long crackdown, from Macau casinos to after-school tutoring to property shares. In late July, regulatory restrictions pushed Hong Kong to second place in Asia, behind Japan, and briefly knocked Tencent off the list of the world’s top ten firms by market capitalization. Add to this, the current development and it will not take much imagination to understand what kind of disaster the Chinese economy is headed towards.