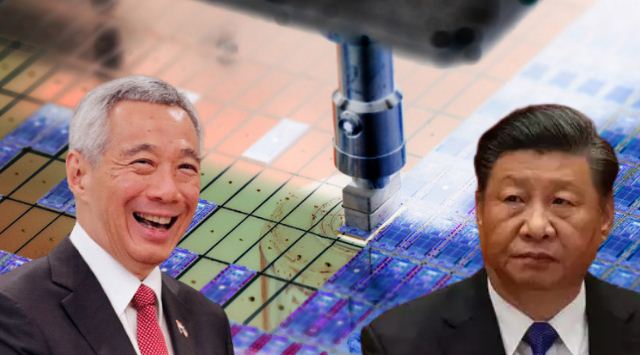

Singapore has already discarded China. But it is now going a step further. It wants to damage China and has decided to hit the paper Dragon where it hurts the most— semiconductor production. Singapore is planning to meet the demand for the next-gen devices with a new US$210 million joint research investment with semiconductor equipment maker Applied Materials.

The US-headquartered Applied Materials and Singapore’s Agency for Science, Technology and Research’s (A*Star) Institute of Microelectronics (IME) are extending their research partnership to 2026. The latest investment will upgrade and expand a joint lab set up by the two entities in 2011, and enable it to accelerate materials, equipment, and process technology solutions for hybrid bonding and other 3D chip integration technologies.

This comes as a huge setback to China, which is itself desperate for semiconductors and is grappling with supplies.

Singapore trying to become a semiconductor giant again

Singapore has always had a healthy semiconductor industry. The country has a favourable taxation and regulatory regime, which also makes it one of the world’s most advanced economies. Singapore also has a good talent pool and some highly skilled workers as well as ease of connectivity, which has promoted a thriving semiconductor industry.

Outside the “big four” in Asia— Taiwan, China, South Korea and Japan, Singapore has the largest semiconductor manufacturing industry in the continent.

Back in 2000, the semiconductor industry in Singapore was doing really well with the production of USD 61.5 billion worth of computer, electronic, and optical products, including semiconductors. The electronics industry in the Southeast Asian nation, however, declined owing to fierce competition from Taiwan, another island nation that loves to hate China.

Yet, Singapore remains a giant in electronics and semiconductor production. As of 2020, the manufacturing of electronics including semiconductors grew to 46.3 percent of the country’s total manufacturing output. Singapore also accounts for 19 percent of the global semiconductor equipment share.

Singapore is a paradise for both foreign chipmakers and local contract manufacturers. Some of the global industry giants like the third-largest semiconductor producer GlobalFoundries, Samsung, Intel, SK Hynix, Micron and Qualcomm maintain a presence in the island city-state.

Singapore is also home to some notable local semiconductor companies like UMS Holdings and test solutions provider AEM Holding. Meanwhile, Singapore is also looking to collaborate with India, and a consortium from Singapore also expressed interest in setting up semiconductor manufacturing facilities in the South Asian country.

How Singapore’s semiconductor resurgence can harm China

It is all about supply chains. Like any other country, for China too, semiconductors are an indispensable product. From car batteries to laptops to smartphones to household appliances to gaming consoles, and everything in between, semiconductors are indispensable in consumer electronics.

However, China is struggling to meet local semiconductor development, ever since the Trump administration crippled its electronics industry with a ban on the export of American-designed models to China. Huawei and SMIC were cut to size after the Trump administration blacklisted these companies and refused to sell semiconductors to them.

China is trying to build a local semiconductor industry, but it is simply not taking off, as going self-reliant in such sophisticated technology is not a cakewalk. Now, if a country like Singapore goes all out to develop a huge semiconductor industry of its own, then Beijing’s crisis will only worsen as the supply chains of these crucial chips will get localised in a country trying to decouple from China.

Singapore trying to untangle itself from China

Singapore’s big semiconductor push is just another episode in its awakening against the China threat.

The Southeast Asian nation understands that its portfolio investment worth billions of dollars and extensive trading ties with the Communist nation is not a great situation to be in.

The Chinese real estate collapse has already hurt Singapore. Modern Land China, a Chinese property developer, failed to pay interest and principal on a $250 million bond, traded in Singapore.

After this episode, Singapore realised that it must untangle its economy from China. Now, Singapore is making it clear that it will go solo, redevelop itself into a semiconductor giant and discard China completely.