In today’s world, the US Dollar is the undisputed king of international currencies.

However, times are changing.

The volatility of the currency has raised several questions about it. The weaponization of the Dollar has made countries look for other options.

This time, Brazil has set the ball of ‘De-dollarisation’ rolling in South America.

Brazil and BRICS

Dilma Rousseff, the ex-president of Brazil, has been selected to be the next leader of the BRICS group’s New Development Bank after Brazil garnered the backing of the other nations in the coalition.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/FXCWLFWBB64QDK4G4S6SPCJNEA.jpg)

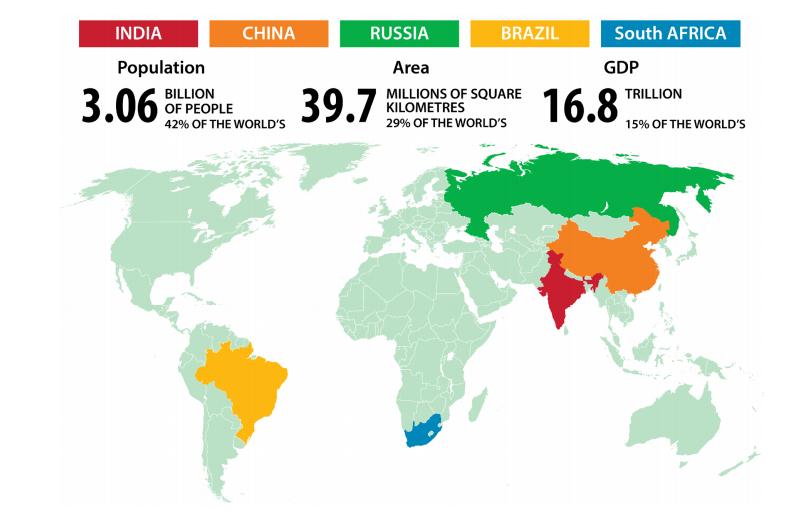

The New BRICS Development Bank, based in Shanghai, China, was established by the BRICS countries. It was formed as an alternative to the World Bank and International Monetary Fund. The BRICS bank is an institution responsible for funding projects in the five countries of the BRICS group.

This would largely benefit Brazil who’s looking for investments after a decade of slow growth. It would also help DE-dollarization among the BRICS nations.

Read More: Lula schools Biden at the White House over the Ukraine war

Under the Bolsonaro administration, Brazil moved more in alignment with Western powers. It had been hesitant to advocate for a BRICS reserve currency.

But now, the new President of Brazil, Lula Da Silva, has expressed his distress regarding the dollar’s dominance in Brazilian trade. He proposed that BRICS be used as a way to de-dollarize. He emphasized that BRICS was not created for defense, but as an offensive tool.

De-dollarization

BRICS countries have already undertaken a project to create a reserve currency to fulfill their economic goals. This currency would be formed from a combination of the Chinese RMB Yuan, the Russian Ruble, the Indian Rupee, the Brazilian Real, and the South African Rand.

Pavel Knyazev, Deputy Director of the Russian Foreign Ministry’s Foreign Policy Planning Department, has confirmed the plan. He said, “The possibility and prospects of setting up a common single currency based on a basket of currencies of the BRICS countries is being discussed.”

The BRICS nations have previously declared their intention to create a shared payment network. The network would decrease their reliance on the Western financial system. Additionally, they have been utilizing local currencies more often in trade.

Knyazev said, “This is not an easy task. The roadmap for the gradual increase in the share of national currencies in mutual settlements. Therefore, I do not think that this process will be accelerated, but the intention is serious.”

Rabbit i.e., Dollar may be ahead right now. But the slow and steady Tortoise wins the race.

South America’s de-dollarisation

Brazil’s efforts may very well resonate in South America. Argentina, the second biggest economy in Brazil, is already looking to become a member of the BRICS group. This will have a domino effect in the region.

Last year, Venezuelan President Nicolas Maduro proposed the promotion of the Sucre, a currency used by the ALBA coalition of states. ALBA consists mainly of Bolivia, Cuba, and other small nations in the West Indies. Additionally, Colombia’s Gustavo Petro is also in favor of integrating Latin America. There are favorable winds across the continent for a common currency.

Also Read: Is a common Latin American Currency feasible?

Argentina and Brazil are already planning on introducing a common currency. It will challenge the dominance of the dollar in the continent. The project can position the Latin American region as a significant geopolitical and economic power. It would be able to export a wide range of goods in addition to being self-sustainable.

The Argentina-Brazil joint statement highlighted the potential of a shared South American currency to decrease external vulnerability. It referred to the vulnerability which comes with the US Dollar. The US has continuously sanctioned countries in the continent which have made it hard for countries to deal with the US dollar in trade.

Therefore, Brazil has set the ball of “De-dollarisation’ rolling in the continent. This could be a major step forward for the region. It could lead to higher investment, reduced transaction costs, and more economic integration.

Is it feasible?

In turn, this could result in improved economic growth and foreign exchange reserves for the countries involved. The success of the currency, however, will depend on how well it is implemented and how much the participating countries are willing to invest in its success.

It will be a major blow for the US. The hegemony of the US largely depends on the US dollar. If the dollar is dethroned, it’ll be a major shift in the twenty-first century in geopolitics.